ATTOM, Irvine, Calif, said properties with foreclosure filings fell by 3 percent in February from January but rose by 18 percent from a year ago.

Category: News and Trends

MISMO Seeks Public Comment on Private-Label RMBS Specification and Implementation Guide

MISMO®, the real estate finance industry standards organization, seeks public comment on the Private-Label Residential Mortgage-Backed Securities (PL RMBS) Specification and Implementation Guide, which will facilitate electronic exchange of mortgage asset data to credit rating agencies.

MBA Secondary and Capital Markets Conference in NYC May 21-24

The Mortgage Bankers Association’s Secondary & Capital Markets Conference returns to the New York Marriott Marquis May 21-24.

Quote: Tuesday Mar. 14, 2023

“This additional tool will allow mortgage servicers to help struggling FHA borrowers stay in their homes through a more affordable and sustainable mortgage payment. Adding the 40-year loan modification to FHA’s loss mitigation toolkit creates better alignment across the government and with Fannie Mae and Freddie Mac, a long-standing MBA priority that we most recently recommended in our new white paper on the future of loss mitigation. Better alignment will improve consumer experience and lead to consistency and simplicity when addressing adverse market conditions, national emergencies and natural disasters.”

–MBA President & CEO Robert Broeksmit, CMB, on an FHA final rule authorizing 40-year loan modifications.

MBA White Paper Addresses Future of Loss Mitigation

The Mortgage Bankers Association released a white paper, The Future of Loss Mitigation, which takes into consideration how lessons applied and learned during the COVID-19 pandemic should shape permanent loss mitigation policy.

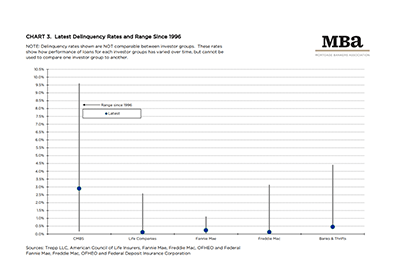

MBA: 4Q Commercial, Multifamily Mortgage Delinquency Rate Remains Low

Commercial and multifamily mortgage delinquencies remained low in the fourth quarter, according to the Mortgage Bankers Association’s latest Commercial/Multifamily Delinquency Report.

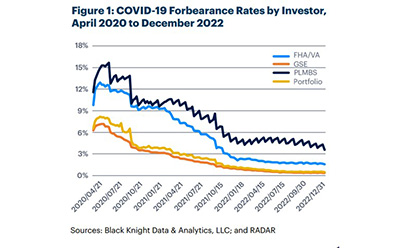

Philly Fed Report Declares Industry Victory on Forbearance

A report commissioned by the Federal Reserve Bank of Philadelphia found more than 95 percent of the estimated 8.5 million borrowers who entered forbearance have exited.

MISMO Seeks Public Comment on Private-Label RMBS Specification and Implementation Guide

MISMO®, the real estate finance industry standards organization, seeks public comment on the Private-Label Residential Mortgage-Backed Securities (PL RMBS) Specification and Implementation Guide, which will facilitate electronic exchange of mortgage asset data to credit rating agencies.

Industry Briefs Mar. 7, 2023: Fitch Ratings Says FHA Premium Cuts ‘Credit Neutral’ for Private Mortgage Insurers

Fitch Ratings, New York, said recently announced reductions in the Federal Housing Authority mortgage insurance premium rates are not expected to have a meaningful credit impact on private U.S. mortgage insurance carriers.

MBA White Paper Addresses Future of Loss Mitigation

The Mortgage Bankers Association released a white paper, The Future of Loss Mitigation, which takes into consideration how lessons applied and learned during the COVID-19 pandemic should shape permanent loss mitigation policy.