The Mortgage Bankers Association on Wednesday launched CONVERGENCE Philadelphia, its third city-based pilot program to promote and increase minority homeownership. CONVERGENCE Philadelphia joins initiatives underway in Memphis, Tenn., and Columbus, Ohio.

Category: News and Trends

FHFA Delays Effective Date of GSE DTI Ratio-Based Fee to Aug. 1

The Federal Housing Finance Agency on Wednesday said it would delay implementation of certain recalibrated upfront fees for Fannie Mae/Freddie Mac until Aug. 1.

U.S. Loses 58 ‘Million-Dollar Cities’ Since July

Zillow, Seattle, said 464 cities in the U.S. have typical home values of $1 million or more. That’s way down from last July, when 522 cities hit the mark.

RIHA Releases Second Collection of Essays on Climate Change’s Impact on Real Estate Finance

The Mortgage Bankers Association’s Research Institute for Housing America published a second collection of essays that addresses affects of climate change on the real estate finance industry.

Quote: Tuesday Mar. 21, 2023

“MBA is developing stronger and more effective affordable housing partnerships to close the minority homeownership gap and create meaningful change in underserved communities. CONVERGENCE Philadelphia will bring together a local network of housing leaders, non-profits and other stakeholders to collaborate on sustainable housing opportunities in the city.”

–MBA President and CEO Bob Broeksmit, CMB.

MBA Secondary and Capital Markets Conference in NYC May 21-24

The Mortgage Bankers Association’s Secondary & Capital Markets Conference returns to the New York Marriott Marquis May 21-24.

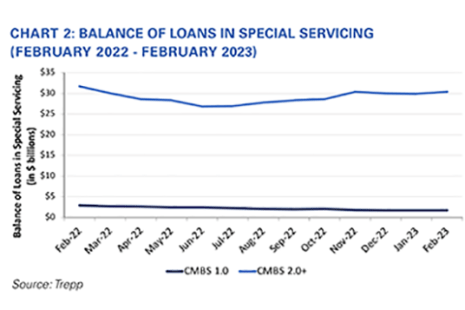

CMBS Delinquency Rate Dips; Special Servicing Rate Increases

Fitch Ratings, New York, reported the commercial mortgage-backed securities delinquency rate decreased two basis points in February to 1.83%.

RIHA Releases Second Collection of Essays on Climate Change’s Impact on Real Estate Finance

The Mortgage Bankers Association’s Research Institute for Housing America published a second collection of essays that addresses affects of climate change on the real estate finance industry.

CoreLogic: 4Q Home Equity Gains Slow Further

CoreLogic, Irvine, Calif., said homeowners with mortgages (which account for roughly 63% of all properties) saw equity slow to a 7.3% increase year over year, representing a collective gain of $1 trillion, for an average of $14,300 per borrower, from one year ago.

Government Roundup: FHA Publishes 40-Year Loan Mod Final Rule; CFPB Targets ‘Junk Fees’

In this week’s Government Roundup, FHA published a final rule that would permit 40-year terms for loan modifications; and the Consumer Financial Protection Bureau released a special edition of its Supervisory Highlights targeting allegedly unlawful junk fees uncovered in deposit accounts and in multiple loan servicing markets, including in mortgage, student and payday lending.