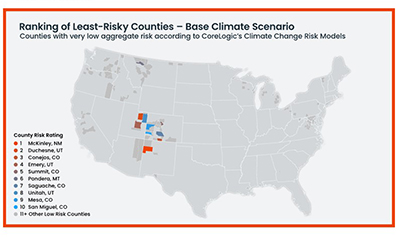

CoreLogic, Irvine, Calif., said counties in the ‘Four Corners’ states—Arizona, Colorado, New Mexico and Utah—rank highest in its annual ‘Safest Place to Live’ study, which details the least risky places to live in the U.S. from a natural hazard perspective.

Category: News and Trends

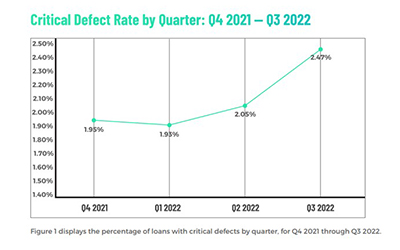

3Q Critical Defect Rate Posts Series High

ACES Quality Management, Denver, said the overall critical defect rate for mortgage underwriting in the third quarter rose to a series high.

Home Flipping at 18-Year High, But Profits Drop Further

ATTOM, Irvine, Calif., reported an increase in home-flipping in 2022, but noted gross profits fell to their lowest point since 2008.

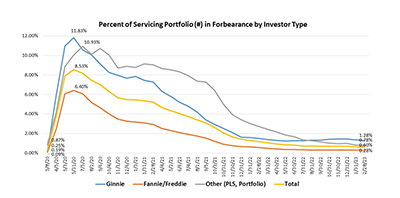

MBA: February Share of Mortgage Loans in Forbearance Decreases to 0.60%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance decreased by 4 basis points tp 0.60% of servicers’ portfolio volume as of February 28 from 0.64% in January. MBA estimates 300,000 homeowners are in forbearance plans.

Quote: Tuesday Mar. 28, 2023

“Securitization is a vital component of commercial and residential mortgage lending as it provides access to much needed capital and the ability to effectively manage risk, and the Proposed Rule, as written, is overly broad and could inadvertently stifle the securitization markets and access to capital.”

–from an MBA letter to the Securities and Exchange Commission on a proposed rule that would clarify what constitutes conflicts of interests in securitizations.

MBA Secondary and Capital Markets Conference in NYC May 21-24

The Mortgage Bankers Association’s Secondary & Capital Markets Conference returns to the New York Marriott Marquis May 21-24.

MBA Legal Issues and Regulatory Compliance Conference in Austin May 7-10

The Mortgage Bankers Association’s annual Legal Issues and Regulatory Compliance Conference takes place May 7-10 at the Hyatt Regency in Austin, Texas. LIRC is the premier event for legal and …

MBA: February Share of Mortgage Loans in Forbearance Decreases to 0.60%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance decreased by 4 basis points tp 0.60% of servicers’ portfolio volume as of February 28 from 0.64% in January. MBA estimates 300,000 homeowners are in forbearance plans.

MBA: 4Q Commercial, Multifamily Mortgage Debt Outstanding Up By $324B

Commercial/multifamily mortgage debt outstanding at year-end 2022 rose by $324 billion (7.7 percent) from the previous year, the Mortgage Bankers Association’s latest quarterly Commercial/Multifamily Mortgage Debt Outstanding Report said.

CFPB Releases 2022 HMDA Data

The Consumer Financial Protection Bureau on Monday made Home Mortgage Disclosure Act Modified Loan Application Register data for 2022 available through the Federal Financial Institutions Examination Council’s HMDA Platform for more than 4,000 HMDA filers.