The Mortgage Bankers Association joined more than 100 industry groups in a letter to Sen. John Thune, R-S.D., expressing support for his re-introducing a bill that would repeal the estate tax.

Category: News and Trends

National Council of State Housing Finance Agencies Announces Affordable Homeownership Lender Toolkit

The National Council of State Housing Finance Agencies, with support from the Mortgage Bankers Association and other industry trade groups, announced availability of the HFA1 Affordable Homeownership Lender Toolkit, a new online resource that will enable home mortgage lenders to partner more efficiently with state housing finance agencies in providing mortgage loans and down payment assistance to lower-income home buyers.

CoreLogic: Mortgage Delinquencies Fall for 22nd Straight Month

CoreLogic, Irvine, Calif., said 2.8% of all mortgages in the U.S. were in some stage of delinquency, down by 0.5 percentage point from 3.3% in January 2022 and by 0.2 percentage point from December.

Quote: Tuesday Apr. 4, 2023

“Commercial real estate markets are already facing headwinds from financial market volatility, economic uncertainty, and higher interest rates. Preparing for new compliance obligations only adds to these challenges and will likely raise costs for borrowers.”

–MBA President & CEO Robert Broeksmit, CMB.

MBA Commercial/Multifamily Finance Servicing and; Technology Conference in Chicago May 9-12

The Mortgage Bankers Association’s annual Commercial/Multifamily Servicing and Technology Conference takes place May 9-12 at the Sheraton Grand Chicago Riverwalk. CMST brings together the biggest names and brightest minds to …

MBA Secondary and Capital Markets Conference in NYC May 21-24

The Mortgage Bankers Association’s Secondary & Capital Markets Conference returns to the New York Marriott Marquis May 21-24.

MBA Letter Addresses Risks to Proposed SEC Rule on Securitizations

The Mortgage Bankers Association, in a Mar. 27 letter to the Securities and Exchange Commission, said a proposed rule to curb certain material conflicts of interest in securitizations is flawed and would present risks to that market.

MBA President and CEO Bob Broeksmit, CMB, on Recent Coverage of Uncertainty in Commercial Real Estate Markets

Bob Broeksmit, CMB, President and CEO of the Mortgage Bankers Association, issued the following statement on recent coverage of uncertainty in commercial real estate markets:

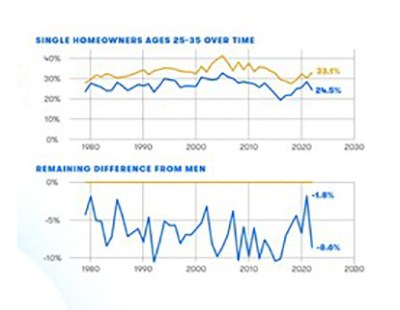

Homeownership Gender Gap Widening

Women have returned to the workforce in near pre-pandemic numbers, but homeownership remains elusive for those who are single, reported Zillow, Seattle.

Fannie Mae, Freddie Mac Complete 52,469 4Q Foreclosure Prevention Actions

Fannie Mae and Freddie Mac completed 52,469 foreclosure prevention actions during the fourth quarter, raising the total number of homeowners who have been helped to 6.7 million since September 2008, the Federal Housing Finance Agency reported.