The Federal Housing Finance Agency recently requested stakeholder input as Fannie Mae and Freddie Mac replace the Classic FICO credit score model with the FICO 10T and the VantageScore 4.0 credit score models, and transition from requiring three credit reports to requiring two credit reports for single-family loan acquisitions.

Category: News and Trends

Report Cites Pandemic’s Impact on Population Shift

Data on 2022 county-level population changes continue to suggest that the coronavirus pandemic had profound and lasting impacts on economic geography—with two million people leaving U.S. cities—according to a report by the Economic Innovation Group, Washington, D.C.

FHFA Final Rule Amends GSEs’ ‘Duty to Serve’ Regulation for ‘Colonias’

The Federal Housing Finance Agency on Apr. 12 published a final rule to amend the Duty to Serve Underserved Markets regulation for Fannie Mae and Freddie Mac. The final rule allows Fannie Mae and Freddie Mac’s activities in all colonia census tracts to be eligible for Duty to Serve credit.

Quote: Tuesday Apr. 18, 2023

“For the first time since inception of MBA’s report in 2008, net production income was in the red in 2022, with losses averaging 13 basis points. The rapid rise in mortgage rates over a relatively short period of time, combined with extremely low housing inventory and affordability challenges, meant that both purchase and refinance volume plummeted. The stellar profits of the previous two years dissipated because of the confluence of declining volume, lower revenues, and higher costs per loan.”

–Marina Walsh, CMB, MBA Vice President of Industry Analysis.

MBA: 2022 IMB Production Profits Fall to Series Low

Independent mortgage banks and mortgage subsidiaries of chartered banks lost an average of $301 on each loan they originated in 2022, down from an average profit of $2,339 per loan in 2021, according to the Mortgage Bankers Association’s Annual Mortgage Bankers Performance Report.

MBA Secondary and Capital Markets Conference in NYC May 21-24

The Mortgage Bankers Association’s Secondary & Capital Markets Conference returns to the New York Marriott Marquis May 21-24.

Sharon Reichhardt of ACES Quality Management: Spring Your QC Forward or Fall Behind Fannie Mae’s New Requirements this September

Given the downturn in mortgage volume and the exploding cost to originate, Fannie Mae’s announcement comes at a time when QC departments may be much leaner than they were the year before. However, lenders can ill afford to ignore these changes, and compliance may mean investing in automation despite declining profitability.

MBA: 2022 IMB Production Profits Fall to Series Low

Independent mortgage banks and mortgage subsidiaries of chartered banks lost an average of $301 on each loan they originated in 2022, down from an average profit of $2,339 per loan in 2021, according to the Mortgage Bankers Association’s Annual Mortgage Bankers Performance Report.

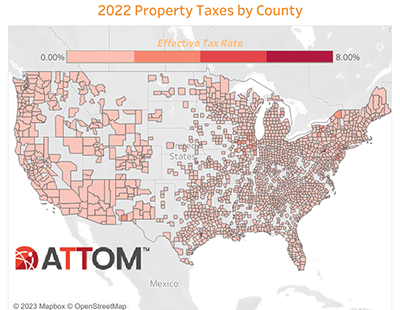

ATTOM: 2022 Single-Family Property Taxes Up 4%

Property taxes on single-family homes grew 3.6% last year, more than double 2021’s 1.6% growth rate, reported ATTOM, Irvine, Calif.

FHFA Updates Equitable Housing Finance Plans for Fannie Mae, Freddie Mac

The Federal Housing Finance Agency updated Fannie Mae and Freddie Mac’s Equitable Housing Finance Plans for 2023.