The Mortgage Bankers Association’s Secondary & Capital Markets Conference returns to the New York Marriott Marquis May 21-24.

Category: News and Trends

Quote: Tuesday Apr. 25, 2023

“Our members have a substantial interest in this case because there is no existing legal authority to hold a lender liable for the acts of a third-party appraiser. In fact, the liability that does exist is for improperly interfering with an appraiser’s independent judgment. We disagree with the CFPB’s and DOJ’s statement that tries to extend liability to lenders for bias arising from the use of independent appraisers.”

–MBA President & CEO Robert Broeksmit, CMB.

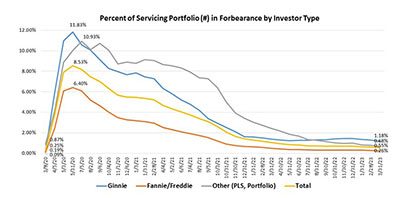

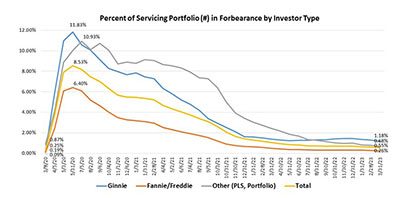

MBA: Share of Mortgage Loans in Forbearance Decreases to 0.55%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance decreased by 5 basis points to 0.55% of servicers’ portfolio volume in March from 0.60% in February.

MISMO Seeks Members for New eHELOC Development Workgroup

MISMO®, the real estate finance industry standards organization, issued a call for participants to join a new development workgroup focused on creating standards for Electronic Home Equity Lines of Credit (eHELOC).

MBA: Share of Mortgage Loans in Forbearance Decreases to 0.55%

The Mortgage Bankers Association’s monthly Loan Monitoring Survey reported loans in forbearance decreased by 5 basis points to 0.55% of servicers’ portfolio volume in March from 0.60% in February.

MBA: 1Q Commercial/Multifamily Mortgage Delinquency Rates Up Slightly

Delinquency rates for mortgages backed by commercial and multifamily properties increased slightly through the first quarter, according to the Mortgage Bankers Association’s latest commercial real estate finance Loan Performance Survey.

MISMO Seeks Members for New eHELOC Development Workgroup

MISMO®, the real estate finance industry standards organization, issued a call for participants to join a new development workgroup focused on creating standards for Electronic Home Equity Lines of Credit (eHELOC).

FHA Seeks Feedback on ‘Granny Flats’ Affordable Financing Access

The Federal Housing Administration last week issued a draft proposal seeking feedback to its requirements for insuring mortgages on single-family homes with Accessory Dwelling Units, popularly known as “granny flats.”

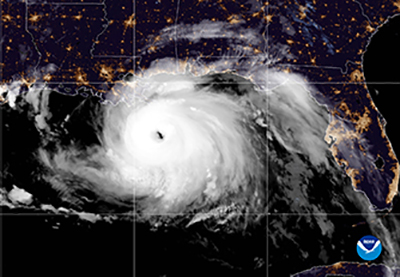

Cushman: Now is the Time to Fight Climate Change

As sea levels rise, the reality of climate change’s impact on the commercial real estate industry is becoming clearer, reported Cushman & Wakefield, Chicago.

Souren Sarkar, CMB, of Nexval: What Recent Flight Fiascos Can Teach Us About Investing in Technology

If mortgage servicers ever needed an argument to not hold back on technology investments, they need look no further than the recent fiascos in the airline industry.