Black Knight, Jacksonville, Fla., said rate lock volumes fell by 22 percent month over month in April despite marginally lower mortgage interest rates.

Category: News and Trends

Fannie Mae: Housing Confidence at 12-Month High

Fannie Mae, Washington, D.C., reported its Home Purchase Sentiment Index increased in April to its highest level since May 2022, jumping 5.5 points to 66.8.

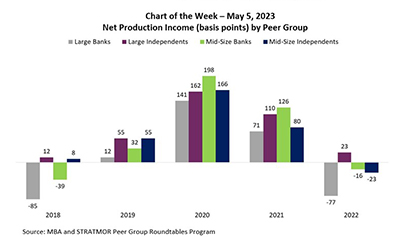

MBA Chart of the Week May 5, 2023: Net Production Income by Peer Group

In this week’s MBA Chart of the Week, we look at pre-tax net production income from a different source – the MBA and STRATMOR Peer Group Roundtables Program.

Home Equity Falters as Housing Market Remains Stalled

ATTOM, Irvine, Calif., released its first-quarter U.S. Home Equity & Underwater Report, showing 47.2 percent of mortgaged residential properties in the United States were considered equity-rich in the first quarter, down slightly from 48 percent in the fourth quarter.

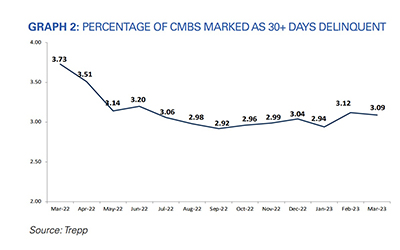

CMBS Delinquency Rate Dips; Offices See Increase

The commercial mortgage-backed securities delinquency rate fell slightly in March, but the segment that everyone watches closely–office–saw its rate move higher again, reported Trepp, New York.

MBA Secondary and Capital Markets Conference in NYC May 21-24

The Mortgage Bankers Association’s Secondary & Capital Markets Conference returns to the New York Marriott Marquis May 21-24.

Quote: Tuesday May 9, 2023

“Unlike most IMBs, some banks can justify operating at a production loss because of the ongoing net interest margin generated on loans held for investment, ability to cross-sell other bank products, and having other business lines that are profit-generating when the mortgage originations division is not.”

–Marina Walsh, CMB, MBA Vice President of Industry Analysis.

MBA Secondary and Capital Markets Conference in NYC May 21-24

The Mortgage Bankers Association’s Secondary & Capital Markets Conference returns to the New York Marriott Marquis May 21-24.

CFPB Proposes New PACE Financing Rules

The Consumer Financial Protection Bureau on Monday proposed a rule to implement a congressional mandate to establish consumer protections for residential Property Assessed Clean Energy (PACE) loans.

Banking, Financial Services Set to Become Largest Investors in AI

The real estate finance industry has long suffered a reputation for lagging other sectors in technology adoption. That perception could soon change, said JLL, Chicago.