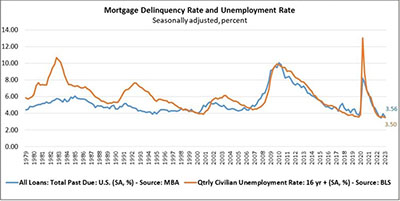

This week’s chart shows that mortgage delinquencies and the unemployment rate continue to track each other closely.

Category: News and Trends

MBA: 1Q Mortgage Delinquency Rates Near Historic Lows

Mortgage delinquency rates fell to near-historic lows in the first quarter, the Mortgage Bankers Association reported Thursday.

#MBACMST23: Loan Maturities–What to Expect When Expecting

CHICAGO–Maturity defaults could increase due to higher interest rates, but they will likely be moderate, panelists said here at the MBA Commercial/Multifamily Finance Servicing and Technology Conference.

MBA Recognizes 17 New Commercial Certified Mortgage Servicer Graduates

CHICAGO–MBA Education, the award-winning education division of the Mortgage Bankers Association, recognized 17 individuals who earned the Commercial Certified Mortgage Servicer (CCMS®) designation at a ceremony held at its 2023 Commercial/Multifamily Finance Servicing and Technology Conference.

#MBACMST23: Facing up to Office Sector Challenges

CHICAGO–The office sector faces major challenges, but servicers and asset managers can handle them, panelists said here at the MBA Commercial/Multifamily Finance Servicing and Technology Conference.

ATTOM: April Foreclosure Activity Declines

ATTOM, Irvine, Calif., reported 32,977 U.S. properties with foreclosure filings — default notices, scheduled auctions or bank repossessions — down 10 percent from a month ago but up 8 percent from a year ago.

TransUnion: Credit Card, Unsecured Personal Loan Balances at or Near Record Levels

TransUnion, Chicago, said consumers are increasingly turning to credit to manage their household budgets in the current economic environment, leading to record- or near-record high balances in credit cards and unsecured loans.

FHFA Rescinds Proposed Loan-Level Pricing Adjustment for DTI Ratios

The Federal Housing Finance Agency on Wednesday rescinded a controversial proposed loan-level pricing adjustment that the Mortgage Bankers Association said would have had adverse impact on both consumers and lenders.

MBA Secondary and Capital Markets Conference in NYC May 21-24

The Mortgage Bankers Association’s Secondary & Capital Markets Conference returns to the New York Marriott Marquis May 21-24.

Quote: Tuesday May 16, 2023

“Consistent with the resilient job market, the performance of existing mortgages is exceeding expectations. Across all states, there was an improvement in the first quarter compared to one year ago. Year-over-year delinquencies for all product types – FHA, VA and conventional – were also down.”

–MBA Vice President of Industry Analysis Marina Walsh, CMB.