MISMO®, the real estate finance industry’s standards organization, is calling for industry professionals to join a new development workgroup (DWG) focused on creating a MISMO-published Title Pricing Application Programming Interface (API) specification.

Category: News and Trends

Seth Sprague, CMB, of Richey May: Now’s the Time to Prepare for FHFA/Ginnie Mae Rules Changes for Non-Bank Servicers

On August 17, 2022, the Federal Housing Finance Agency and Ginnie Mae jointly announced updated minimum financial eligibility and capital rules for seller/servicers and issuers. These changes update the capital and financial eligibility requirements for non-bank servicers that have been modified over the past year.

Quote: Tuesday, May 30, 2023

“Economic conditions are still hitting at the most critical moments in the homeownership process: the down payment, the monthly payment and the first five years of homeownership, when capital assets are at their most critical.” –David Battany, Executive Vice President of Capital Markets with Guild Mortgage Co., San Diego.

#MBASecondary23: Broeksmit: ‘You Don’t Need Punishment or More Regulation; You Need Praise and Relief—and You Need it Now’

NEW YORK—When Mortgage Bankers Association President & CEO Bob Broeksmit, CMB, stepped on stage Monday here at the National Secondary Market Conference & Expo, he promised a presentation “more pugnacious than normal.” And he delivered.

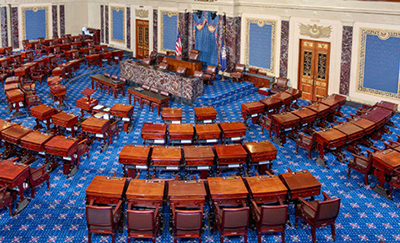

Senators Introduce MBA-supported Bill to Reform Davis-Bacon Rules

Sens. John Thune, R-S.D., and Jerry Moran, R-Kan., on Friday reintroduced the Housing Supply Expansion Act, legislation that would address the affordable housing shortage by making targeted reforms to Davis-Bacon Act requirements.

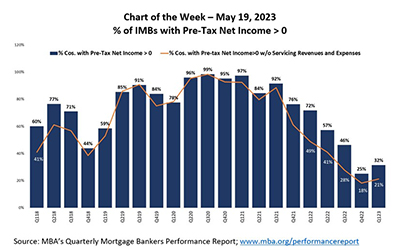

MBA Chart of the Week May 19, 2023: % of IMBs with Pre-Tax Net Income

Today’s Chart of the Week compares the percentage of companies in the QPR that reported positive pre-tax net income including all lines of business (e.g. production and servicing operations), versus the percentage of companies that reported positive pre-tax net income, once servicing operations are excluded.

Elevating Your Quality Quotient, Part II: Mortgage Servicing Post-Pandemic

Regulations offer guardrails, but rebuilding trust is key to a vibrant mortgage servicing industry. The hurdles of the Great Financial Crisis have been largely overcome and the COVID-19 Pandemic National Emergency was formally decreed behind us on April 10. So, what does the marketplace for servicing look like today and what aspects of servicing could look different in the future?

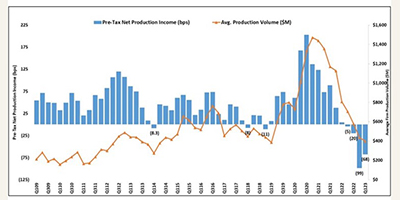

MBA: IMBs Report Pre-Tax Net Production Losses in 1Q

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a net loss of $1,972 on each loan they originated in the first quarter, an improvement from the reported loss of $2,812 per loan in the fourth quarter, the Mortgage Bankers Association reported Thursday.

Quote: Tuesday, May 23, 2023

“Conditions continue to be challenging for the industry, with now four consecutive quarters of production losses and nine consecutive quarters of volume declines.”

–Marina Walsh, CMB, MBA Vice President of Industry Analysis.

FHA Finalizes HECM Claims Processing Policies

The Federal Housing Administration on Wednesday announced new policies that will allow for faster payment of funds to mortgagees when they assign a Home Equity Conversion Mortgage (HECM), also known as a reverse mortgage, to HUD.