Foreclosure filings–default notices, scheduled auctions or bank repossessions–increased 7% in May from April and 14% from a year ago, reported ATTOM, Irvine, Calif.

Category: News and Trends

School of Multifamily Property Inspections in Dallas July 19-20

MBA Education’s School of Multifamily Property Inspections is designed to help originators, asset managers, underwriters, servicers and those inspecting multifamily properties better understand the nuances of physical property conditions, as well as the appropriate way to perform efficient physical inspections.

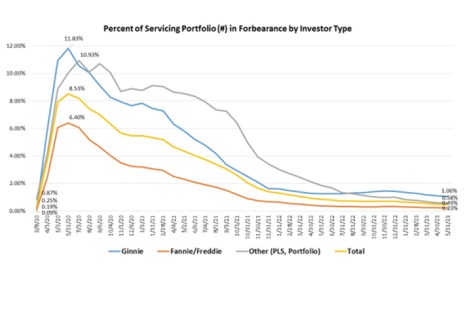

MBA: Share of Mortgage Loans in Forbearance Drops to 0.49% in May

The total number of loans now in forbearance decreased to 0.49% for May from 0.51% of servicers’ portfolio volume in April, the Mortgage Bankers Association’s monthly Loan Monitoring Survey reported.

Fitch: RMBS Servicers Focus on Struggling Borrowers; Delinquencies Remain Flat

Servicers continued to work with struggling homeowners to avoid loan default as delinquent loans remained flat in late 2022, according to Fitch Ratings’ fourth-quarter U.S. RMBS Servicer Metric Report.

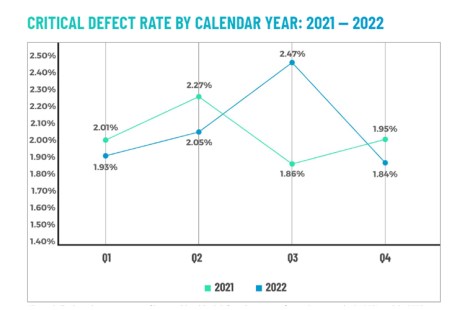

Critical Defect Rate Drops in Q4 2022, ACES Finds

ACES Quality Management, Denver, found the overall critical defect rate declined to 1.84% in Q4 2022.

Fed Keeps Rates Steady But Options Open

The Federal Open Market Committee held rates steady at its June meeting but kept its options open for July and later this year.

Deadline July 3: Apply for MBA Education’s Residential Educator of the Year

The Mortgage Bankers Association announced that applications have opened for MBA Education’s Residential Educator of the Year Award.

MBA Comments on HUD COVID-Related Loss Mitigation Report

The HUD Office of the Inspector General issued two audit reports Thursday examining the loss mitigation options that loan servicers provided to borrowers with FHA-insured loans after their COVID-19 forbearance ended.

MISMO Seeks Public Comment on New Standardized Dataset for VA Verification of Benefits

MISMO®, the real estate finance industry’s standards organization, announced at its 2023 Spring Summit it is seeking public comment on a MISMO dataset mapping for the U.S. Department of Veterans Affairs Verification of Benefits (Form 26-8937).

Mortgage Cadence EVP of Services Jim Rosen: Seeing the Return From Our AI Investments

When we think of the investments that companies are making in new AI-powered software, the big tech firms spring to mind first. With Google investing over $300 billion and Facebook and Microsoft close behind, it’s clear that someone thinks “thar’s gold in them there mountains.”