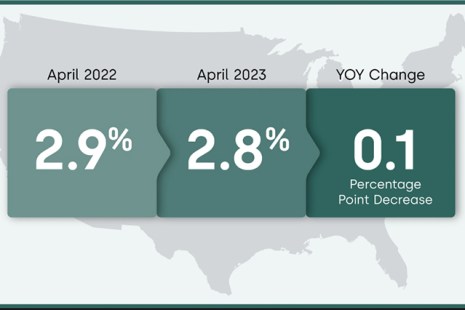

CoreLogic, Irvine, Calif., released its Loan Performance Insights Report for April, showing that despite some small upticks in certain areas, mortgage delinquencies remain near record lows.

Category: News and Trends

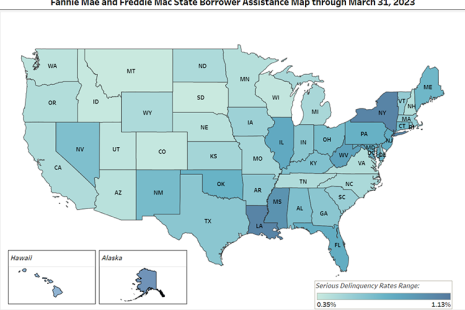

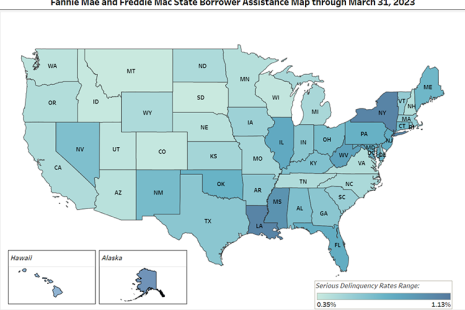

FHFA: More Than 6.7M Troubled Homeowners Helped During Conservatorships

Fannie Mae and Freddie Mac completed 58,268 foreclosure prevention actions in the first quarter, the Federal Housing Finance Agency reported.

Quote Tuesday, July 11, 2023

“Mortgage performance remained strong in April, with overall delinquencies at minimal levels and serious delinquencies at a 23-year low.”

–Molly Boesel, Principal Economist for CoreLogic, Irvine, Calif.

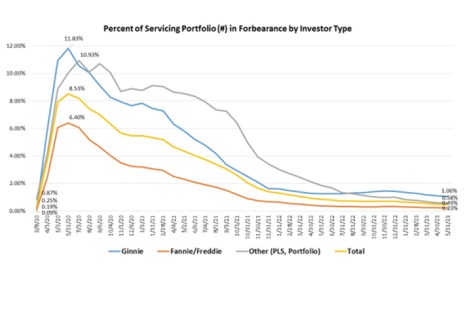

MBA: Share of Mortgage Loans in Forbearance Drops to 0.49% in May

The total number of loans now in forbearance decreased to 0.49% for May from 0.51% of servicers’ portfolio volume in April, the Mortgage Bankers Association’s monthly Loan Monitoring Survey reported.

S&P Global Ratings: Selective Defaults Increase

Selective defaults have increased in recent years, which can create a “slippery slope” to future defaults, reported S&P Global Ratings, New York.

FHFA: More Than 6.7M Troubled Homeowners Helped During Conservatorships

Fannie Mae and Freddie Mac completed 58,268 foreclosure prevention actions in the first quarter, the Federal Housing Finance Agency reported Friday.

Black Knight: Past-Due Mortgages Approach Record Lows, Serious Delinquencies Continue to Improve

Black Knight, Jacksonville, Fla., reported the national delinquency rate fell 11 basis points in May to 3.1%, the lowest level it’s hit other than a record of 2.92% in March.

To the Point with Bob: Regulators: Take Steps to Recognize Warehouse Lenders’ Important Role in Today’s Housing Finance Market

This is a difficult time for the housing industry, and those challenges extend to all corners—not only mortgage lenders but also the warehouse lenders, vendors, title companies, and real estate agents that support the housing and mortgage finance ecosystem.

U.S. Foreclosure Activity Spikes in May

Foreclosure filings–default notices, scheduled auctions or bank repossessions–increased 7% in May from April and 14% from a year ago, reported ATTOM, Irvine, Calif.

Deadline July 3: Apply for MBA Education’s Residential Educator of the Year

Applications have opened for MBA Education’s Residential Educator of the Year Award. The deadline is July 3.