MISMO®, the real estate finance industry’s standards organization, announced the final release of the latest version of the MISMO Life of Loan Process Model.

Category: News and Trends

Large Banks Performed Well in Fed Stress Test: S&P Global Ratings

Share buybacks by large banks will likely remain subdued this year despite “encouraging” results from the Federal Reserve’s latest stress test, S&P Global Ratings said in a non-rating action titled “Banks Held Up Well In The Fed’s Stress Test, But They Likely Won’t Ramp Up Share Buybacks.”

MBA Opens Doors Foundation Raises Nearly $235,000 During MBA’s Chairman’s Conference

The MBA Opens Doors Foundation announced it raised $234,536 at its Annual Charity Wine Auction held during MBA’s June Chairman’s Conference in Manalapan, Fla.

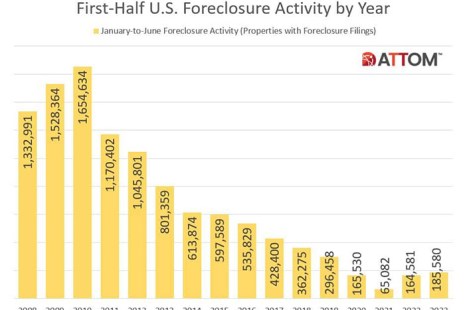

Foreclosure Activity Increases

ATTOM, Irvine, Calif., found a total of 185,580 U.S. properties with foreclosure filings–default notices, scheduled auctions or bank repossessions–between January and June, up 13% from a year ago.

Fitch: Office Property Performance to Worsen Amid Rising Market Pressures

Office loan performance will likely continue to weaken as market pressures build, reported Fitch Ratings, New York.

Incenter’s Piercy, Dowell and Hamrick: Optimizing MSR Trades While Minimizing Risks

Mortgage servicing rights trading has remained brisk thus far in 2023. To help buyers and sellers capitalize on this important strategy while minimizing their risks, MBA NewsLink interviewed Tom Piercy, Managing Director, and Bob Dowell, Managing Director, Analytics, with Incenter Mortgage Advisors and Pamela Hamrick, President of Incenter Diligence Solutions.

Quote Tuesday, July 18, 2023

“Mortgage forbearance has declined because most homeowners have maintained or improved their financial health. Recent reporting by the U.S. Bureau of Labor Statistics shows continued job growth in June and a 3.6 percent unemployment rate. The employment situation tracks with homeowners’ ability to make mortgage payments.”

–Marina Walsh, CMB, MBA Vice President of Industry Analysis.

Fitch Ratings: Non-Bank Mortgage Lenders to Withstand Liquidity, Funding Pressures

U.S. non-bank mortgage companies are positioned to withstand liquidity and funding pressures amid the fallout from recent bank failures, growing recessionary risks and tightening lending standards, reported Fitch Ratings, New York.

Incenter’s Piercy, Dowell and Hamrick: Optimizing MSR Trades While Minimizing Risks

Mortgage servicing rights trading has remained brisk thus far in 2023. To help buyers and sellers capitalize on this important strategy while minimizing their risks, MBA NewsLink interviewed Tom Piercy, Managing Director, and Bob Dowell, Managing Director, Analytics, with Incenter Mortgage Advisors and Pamela Hamrick, President of Incenter Diligence Solutions.

MBA Research Roundup June 2023

Each month, MBA Research releases a roundup of recent data, activities and other pertinent developments crucial to the real estate finance industry.