An organization is run by its people. Managing risk is a key factor to strategic business planning and success. So the saying that everyone is a risk manager may sound cliché and simple, but it’s absolute. How to effectively manage risk and build out a risk infrastructure has evolved dramatically through the years.

Category: News and Trends

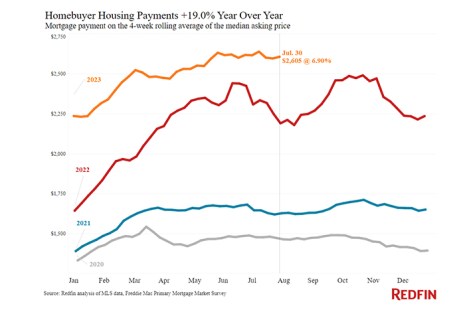

Redfin: Typical Monthly Payment Up Nearly 20% From Last Year

Redfin, Seattle, found the typical U.S. homebuyer’s monthly payment is up 19% from a year ago, at $2,605, during the four weeks ending July 30.

Homeowner Housing Vacancy Rate Dips YoY; Rental Vacancy Rate Increases

The Census Bureau, Washington, D.C., said the homeowner vacancy rate fell slightly in the second quarter compared to a year ago while the rental vacancy rate increased.

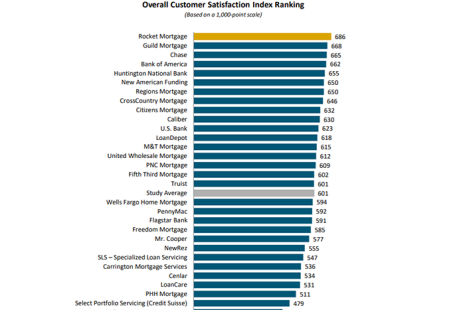

Uncertainty, Financial Challenges Driving Down Satisfaction with Mortgage Servicers

With mortgage rates at their highest level since November 2022 and costs for everything from home insurance to maintenance still elevated, mortgage servicer customers are feeling strained, reported J.D. Power, Troy, Mich.

MISMO Seeks Public Comment on Tools Aimed at Enhancing Business Efficiency

MISMO, the real estate finance industry’s standards organization, announced that it is seeking public comments on the latest version of the MISMO Life of Loan Process Model, and an updated version of the MISMO Business Glossary.

Tavant’s Mohammad Rashid and Equifax Workforce Solutions’ Chad Whittenberg Discuss Technological Advances

MBA NewsLink interviewed Mohammad Rashid, Senior Vice President and Head of Fintech Innovation with Tavant, and Chad Whittenberg, Vice President of Strategy, Product and Marketing with Equifax Workforce Solutions, about how technological advances have completely changed how mortgage lenders conduct business.

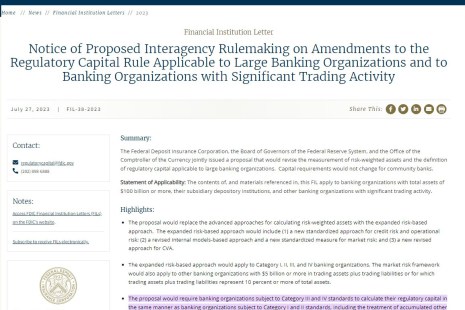

Banking Agencies Issue MBA-Opposed Proposed Changes to Bank Capital Requirements

The Federal Reserve, Federal Deposit Insurance Corporation, and Office of the Comptroller of the Currency on Thursday issued interagency proposed changes to capital requirements for banks with assets of $100 billion or more. MBA strongly opposes certain provisions of the proposal.

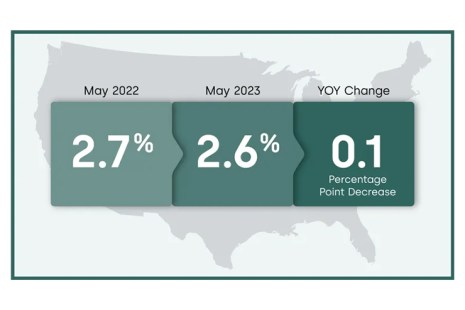

CoreLogic: Mortgage Delinquency Rate at Record Low in May

CoreLogic, Irvine, Calif., reported in May just 2.6% of all mortgages in the U.S. were in some stage of delinquency, matching the all-time low.

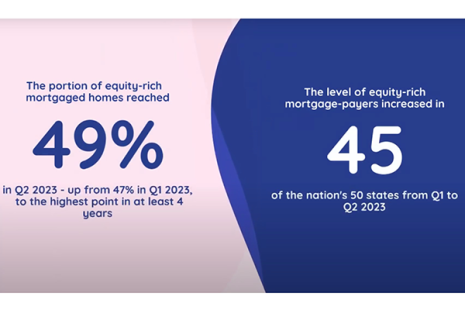

Homeowner Equity Improves in Second Quarter

ATTOM, Irvine, Calif., reported nearly half–49%–of mortgaged residential properties in the United States were considered equity-rich in the second quarter, up from 47% in early 2023.

MBA Compliance and Risk Management Conference in D.C. Sept. 10-12

Two conferences, one monumental location: The Mortgage Bankers Association’s all-new Compliance and Risk Management Conference takes place Sept. 10-12 at the Grand Hyatt Washington, D.C. We combined two of your …