MBA NewsLink interviewed Mohammad Rashid, Senior Vice President and Head of Fintech Innovation with Tavant, and Chad Whittenberg, Vice President of Strategy, Product and Marketing with Equifax Workforce Solutions, about how technological advances have completely changed how mortgage lenders conduct business.

Category: News and Trends

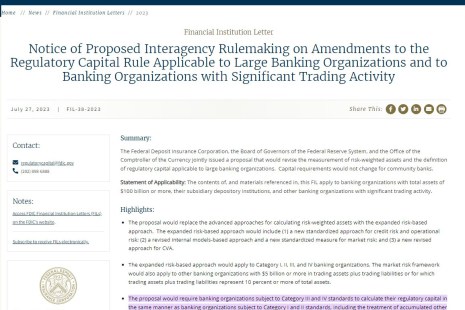

Banking Agencies Issue MBA-Opposed Proposed Changes to Bank Capital Requirements

The Federal Reserve, Federal Deposit Insurance Corporation, and Office of the Comptroller of the Currency on Thursday issued interagency proposed changes to capital requirements for banks with assets of $100 billion or more. MBA strongly opposes certain provisions of the proposal.

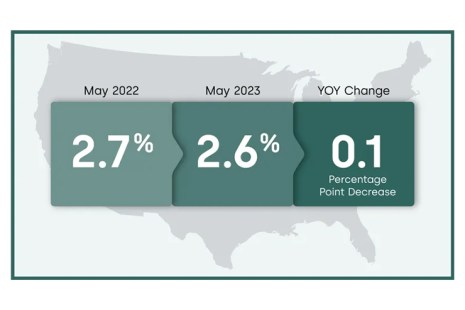

CoreLogic: Mortgage Delinquency Rate at Record Low in May

CoreLogic, Irvine, Calif., reported in May just 2.6% of all mortgages in the U.S. were in some stage of delinquency, matching the all-time low.

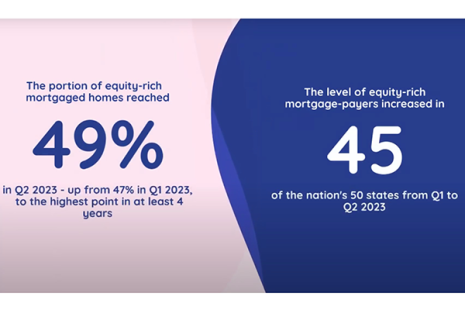

Homeowner Equity Improves in Second Quarter

ATTOM, Irvine, Calif., reported nearly half–49%–of mortgaged residential properties in the United States were considered equity-rich in the second quarter, up from 47% in early 2023.

MBA Compliance and Risk Management Conference in D.C. Sept. 10-12

Two conferences, one monumental location: The Mortgage Bankers Association’s all-new Compliance and Risk Management Conference takes place Sept. 10-12 at the Grand Hyatt Washington, D.C. We combined two of your …

Quote Tuesday, Aug. 1, 2023

“Home renovations and remodeling drove demand for home equity products in 2022, with roughly two-thirds of borrowers citing it as a reason for applying for a home equity loan.”

–Marina Walsh, CMB, MBA Vice President of Industry Analysis

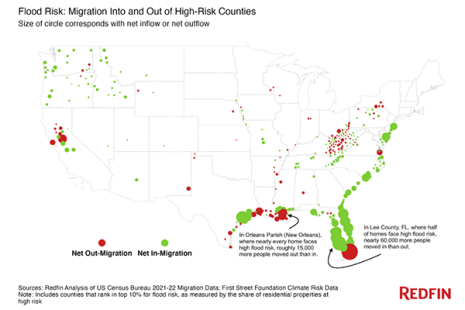

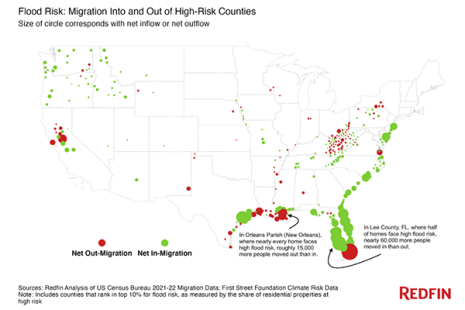

Redfin Reports Migration Into Flood-Prone Areas Has More Than Doubled Since 2020

The most flood-prone U.S. counties saw 384,000 more people move in than out in 2021 and 2022—a 103% increase from the prior two years, reported Redfin, Seattle.

MBA: Home Equity Lending Volume Rose in 2022 as Home Renovations Drive Demand

Originations of open-ended Home Equity Lines of Credit and closed-end home equity loans increased 50% in 2022 compared to two years earlier. This is according to the Mortgage Bankers Association’s Home Equity Lending Study, released for the first time since 2020.

Devin Daly of TRUE: AI is Changing Quality Control and Transforming the Mortgage Industry

MBA NewsLink interviewed Devin Daly, Chief Revenue Officer with TRUE, about how AI is transforming the industry for mortgage borrowers, lenders and servicers.

Redfin Reports Migration Into Flood-Prone Areas Has More Than Doubled Since 2020

The most flood-prone U.S. counties saw 384,000 more people move in than out in 2021 and 2022—a 103% increase from the prior two years, reported Redfin, Seattle.