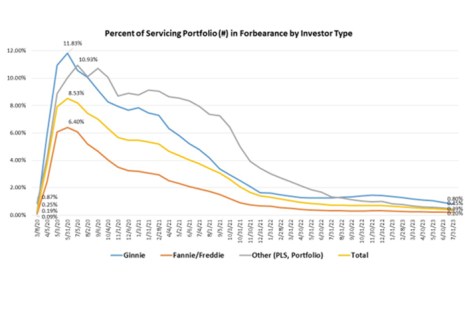

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 5 basis points from 0.44% of servicers’ portfolio volume in the prior month to 0.39% as of July 31.

Category: News and Trends

Clarifire’s Jane Mason: To Survive, the Fittest Organizations Need AI—But That’s Not All

AI holds the potential to unleash productivity throughout the mortgage lifecycle by bringing the origination and servicing sides of the business together.

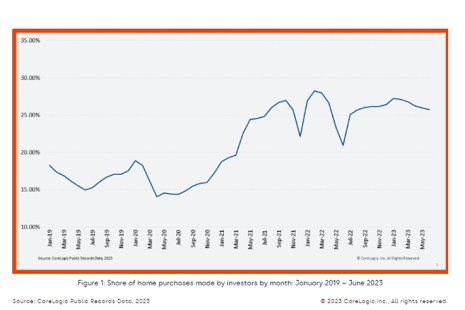

Home Investor Share Remains High, CoreLogic Finds

CoreLogic, Irvine, Calif., reported the U.S. home investor share remained high throughout the early summer, with 26% of all single-family home purchases in June.

Quote Tuesday, Aug. 22, 2023

“Given the recent natural disasters impacting California, Washington, and Hawaii, forbearance is one way for mortgage servicers to mitigate the potential impacts on homeowners.”

–Marina Walsh, CMB, MBA Vice President of Industry Analysis.

Haven’t Reevaluated Your Document Automation Strategy Yet? Now’s the Time

Whether you’re an originator, servicer, wholesale lender or investor, managing loan documents and data effectively can mean the difference between the success or failure of your process automation strategies.

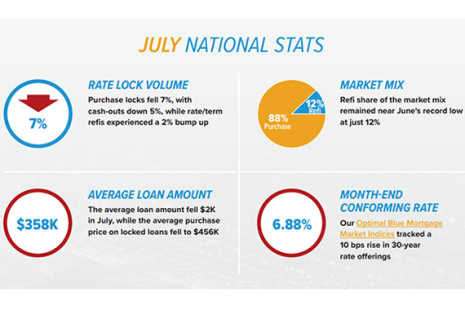

Black Knight Reports Mortgage Rate Lock Activity Falls Again

Black Knight, Jacksonville, Fla., said mortgage rate lock activity fell for the second consecutive month in July, dropping 7% overall.

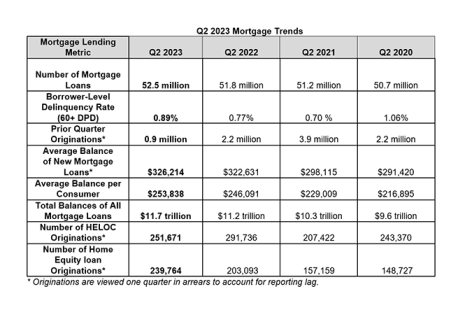

TransUnion: Mortgage Balances Remain Near Record Highs; More Consumers Turn to Home Equity Loans

TransUnion, Chicago, said total mortgage balances fell to $11.7 trillion in the second quarter, down slightly from last quarter’s record high but up 4.3% year-over-year.

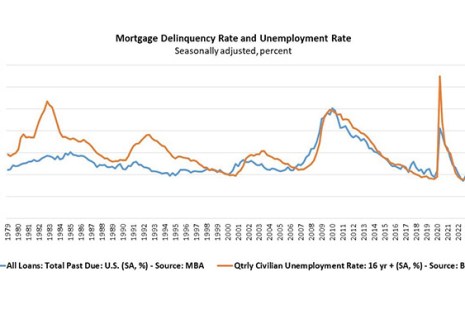

MBA: Mortgage Delinquencies Decrease in Second Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 3.37 percent of all loans outstanding at the end of the second quarter, according to the Mortgage Bankers Association’s National Delinquency Survey.

Foreclosure Starts Down in July, but Repossessions Increase, ATTOM Finds

ATTOM, Irvine, Calif., found in its July 2023 U.S. Foreclosure Market Report that foreclosure starts are down 12% from June and down 2% from a year ago.

Cenlar’s Sara Avery: Building an Effective Risk-Aware Culture

An organization is run by its people. Managing risk is a key factor to strategic business planning and success. So the saying that everyone is a risk manager may sound cliché and simple, but it’s absolute. How to effectively manage risk and build out a risk infrastructure has evolved dramatically through the years.