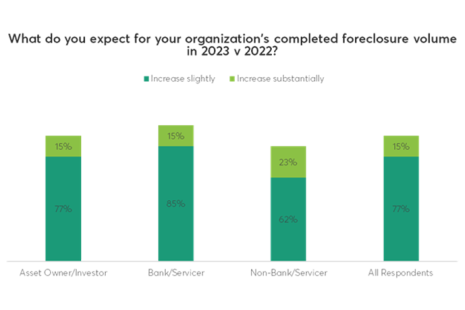

More than nine in 10 default servicing industry leaders expect completed foreclosure auction volume to increase this year compared to 2022, reported Auction.com, Irvine, Calif.

Category: News and Trends

Black Knight: Foreclosure Inventory Very Low, Serious Delinquencies Down in July

Black Knight, Jacksonville, Fla., reported its “first look” at July 2023 mortgage performance statistics, finding that serious delinquencies continue to improve.

MISMO Releases Consumer Home Equity SMART Doc Standardized Mapping and Updated Implementation Guide

MISMO, the real estate finance industry’s standards organization, announced that it is publishing Version 2.1 of the SMART Doc 1.02 Standard Mapping and Implementation Guide as final.

Quote Tuesday, Aug. 29, 2023

“The new version of the SMART Doc 1.02 Standardization Mapping and Implementation Guide will provide helpful guidance to mortgage service providers who are looking to streamline the creation of home equity first lien eNotes.”

–David Coleman, President, MISMO

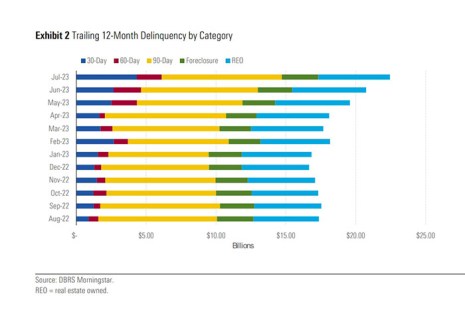

DBRS Morningstar: CMBS Delinquency Rate Surges

DBRS Morningstar, Toronto, reported the delinquency rate for loans packaged in commercial mortgage-backed securities surged 31 basis points in July. The special servicing rate rose for the fifth straight month, increasing 24 basis points during July.

MBA: IMBs Report Net Production Losses in the Second Quarter

Independent mortgage banks and mortgage subsidiaries of chartered banks reported a pre-tax net loss of $534 on each loan they originated in the second quarter, an improvement from the reported loss of $1,972 per loan in the first quarter of 2023, according to the Mortgage Bankers Association’s Quarterly Mortgage Bankers Performance Report.

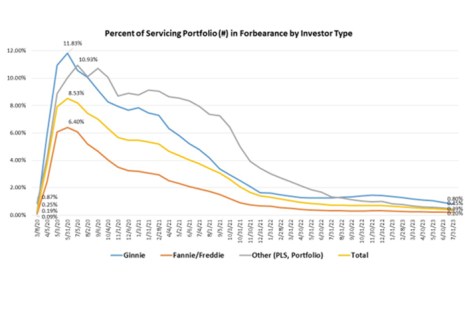

MBA: Share of Mortgage Loans in Forbearance Decreases to 0.39% in July

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 5 basis points from 0.44% of servicers’ portfolio volume in the prior month to 0.39% as of July 31.

Clarifire’s Jane Mason: To Survive, the Fittest Organizations Need AI—But That’s Not All

AI holds the potential to unleash productivity throughout the mortgage lifecycle by bringing the origination and servicing sides of the business together.

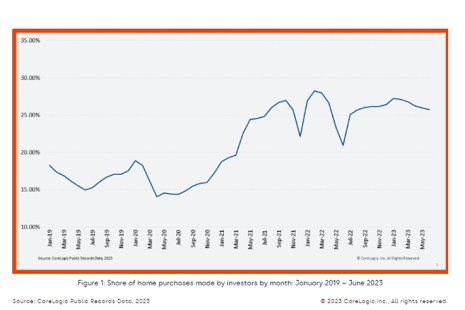

Home Investor Share Remains High, CoreLogic Finds

CoreLogic, Irvine, Calif., reported the U.S. home investor share remained high throughout the early summer, with 26% of all single-family home purchases in June.

Quote Tuesday, Aug. 22, 2023

“Given the recent natural disasters impacting California, Washington, and Hawaii, forbearance is one way for mortgage servicers to mitigate the potential impacts on homeowners.”

–Marina Walsh, CMB, MBA Vice President of Industry Analysis.