While mortgage origination has experienced massive improvements through digital technology, the same has not always been true for the servicing side of the business.

Category: News and Trends

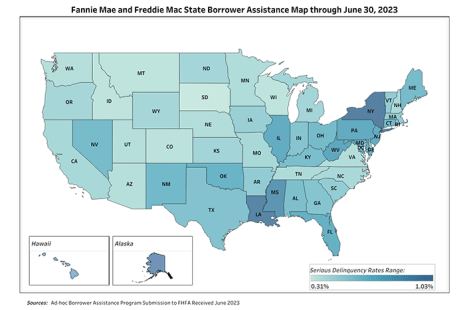

FHFA: GSEs Completed 47,370 Foreclosure Prevention Actions During Second Quarter

Fannie Mae and Freddie Mac completed 47,370 foreclosure prevention actions during the second quarter, raising the total number of homeowners helped to 6.8 million since the conservatorships started in 2008, the Federal Housing Finance Agency reported.

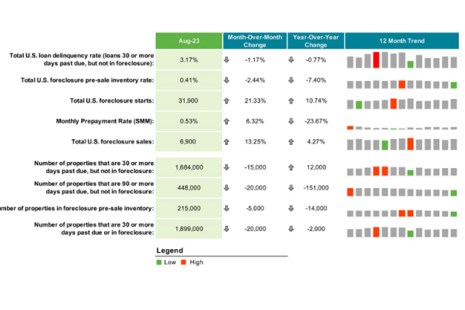

Black Knight: First Look August Delinquency Numbers Positive

Black Knight, Jacksonville, Fla., released its First Look at its August Mortgage Monitor, finding that the delinquency rate improved yet again, but gains are slowing. That, Black Knight said, might suggest delinquency rates are reaching cycle lows.

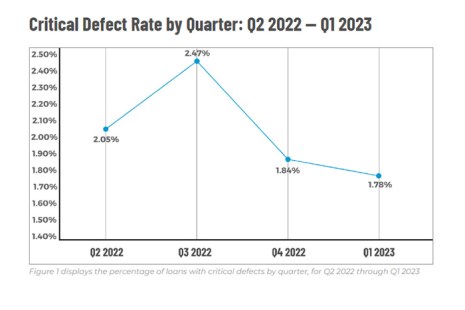

ACES: Critical Defect Rate Down for Q1 2023

ACES Quality Management, Denver, reported the overall critical defect rate for the first quarter of 2023 was 1.78%. That’s down 3.26% from the previous quarter, and the second straight quarter of declines.

BSI Financial Services’ Allen Price: How Digital-First Subservicers Are Revolutionizing Servicing

While mortgage origination has experienced massive improvements through digital technology, the same has not always been true for the servicing side of the business. On the whole, mortgage servicers are not typically known for being particularly innovative or technology driven.

ATTOM: Home Flipping Drops in Q2

(Image courtesy of ATTOM) ATTOM, Irvine, Calif., found home flipping activity fell in the second quarter. Per its second-quarter 2023 U.S. Home Flipping Report, 8% of single-family homes and condominiums were …

Servicing Quote Tuesday, Sept. 26, 2023

“While the overall critical defect rate is trending in the right direction, there are several key areas of concern that will require lenders to remain vigilant to ensure defects continue heading southward, especially as the GSEs and agencies continue to increase their scrutiny of lenders’ production quality.”

–Nick Volpe, Executive Vice President of ACES Quality Management

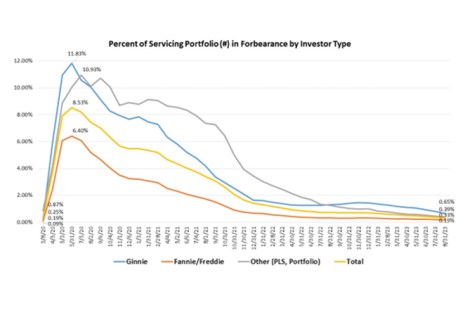

Share of Mortgage Loans in Forbearance Decreases to 0.33% in August

The Mortgage Bankers Association’s (MBA) monthly Loan Monitoring Survey revealed that the total number of loans now in forbearance decreased by 6 basis points from 0.39% of servicers’ portfolio volume in the prior month to 0.33% as of August 31, 2023. According to MBA’s estimate, 165,000 homeowners are in forbearance plans. Mortgage servicers have provided forbearance to approximately 7.92 million borrowers since March 2020.

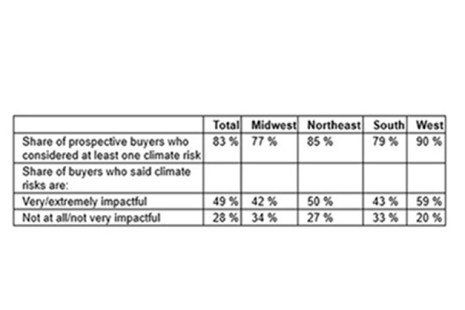

More Than 80% of Home Buyers Consider Climate Risks When Shopping for a Home: Zillow

New Zillow research shows that more than 80% of prospective home buyers consider climate risks as they shop.

MISMO Seeks Nominations for Standards Governance Committee Members by Oct. 6

MISMO, the real estate finance industry’s standards organization, seeks nominations for qualified industry professionals to serve on MISMO’s Standards Governance Committees for a two-year term beginning in January 2024. Positions are available on both the Residential and Commercial Standards Governance Committees.