One report says Austin, Texas will be the nation’s hottest housing market in 2021. Another report says it already is.

Tag: Zillow

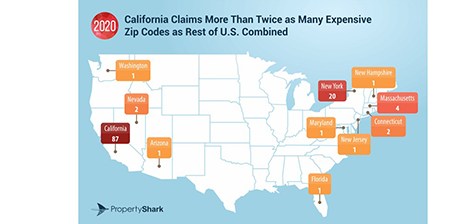

Pandemic Year Brings Huge Surge in ‘Million-Dollar Cities’

Move over, San Francisco Bay Area and New York City; you’ve got company—lots of it.

Renters Struggle as Income Stagnates, Unemployment Remains High

Renters’ median income growth stopped last year, and more than three million renters who face COVID-19 unemployment carry extreme housing cost burdens, analysts said.

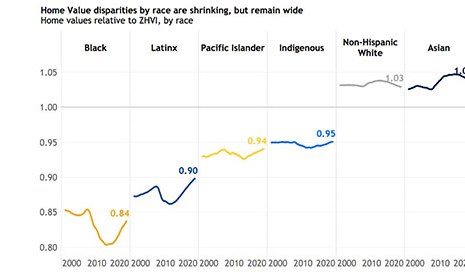

Zillow: Racial Home Value Disparities Shrinking, But Persist

The Zillow analysis said homes owned by Black and Latino households are worth 16.2% and 10.2% less, respectively, than the typical U.S. home — gaps that have closed by about 4 percentage points from their widest points following the Great Recession.

Housing Market Roundup, Dec. 24, 2020

It’s almost the end of a year many of us would like to forget—unless, of course, we’re a mortgage banker. Here’s a summary of a plethora of reports that crossed the MBA NewsLink desk in the past few days:

Housing Market Roundup

So much news, so little time and space. The end of the year seems to bring out the volume in housing market reports, so here are a couple paragraphs each on some of the latest reports to come across our desks:

Housing Roundup Nov. 23, 2020

Here’s a quick hit on several recent housing and real estate finance reports.

Generation Z Renters Moving On Up

More young adults are returning to the rental market reported Zillow, Seattle.

Housing Market Roundup Nov. 16, 2020

Redfin, Seattle, said popular second-home destinations including the Jersey Shore, Cape Cod, Lake Tahoe, Palm Springs and Bend, Ore., are heating up and becoming full-time residences for homebuyers who have the luxury of working remotely.

For Many, Despite Low Mortgage Rates, Down Payments Out of Reach

Even though mortgage affordability has improved since 2018 because of ultra-low mortgage rates, home values have grown at nearly twice the rate of incomes over the past six years, said Zillow, Seattle, making saving for a down payment—particularly for first time buyers—a challenge.