Housing Roundup Nov. 23, 2020

(Chart courtesy of Property Shark, New York.)

Here’s a quick hit on several recent housing and real estate finance reports.

BAI: Improving Customer Experience Remains Top Business Challenge for Financial Services Organizations

BAI, Chicago, unveiled new research addressing the top priorities on financial services leaders minds and changing consumer attitudes in 2021. Highlights of BAI Banking Outlook: What You Need to Know to Prepare for 2021, include.

–Improving customer digital experience remains the top business challenge for financial services leaders. The top request from consumers is the ability to customize their own solutions, from products to the digital experience.

–While satisfied with their current digital banking offerings, 54% of total consumers across all generations note they are willing to switch primary financial services organizations for better mobile banking and digital capabilities.

–55% of leaders plan to collaborate with outside fintech companies to deliver products and services in 2021.

–63% of consumers are open to banking with non-traditional financial services organizations such as Amazon, Apple and PayPal compared to 48% the year prior.

“With the continuing pandemic and challenges from social unrest, 2021 will be a year of certain change in which financial services leaders will need to quickly adapt to shifting market forces as they have over the past year,” said Karl Dahlgren, managing director with BAI. “Aligning priorities and investments to what consumers need most to navigate their changing world will be critical for financial services organizations to remain successful, relevant and competitive in the coming year.”

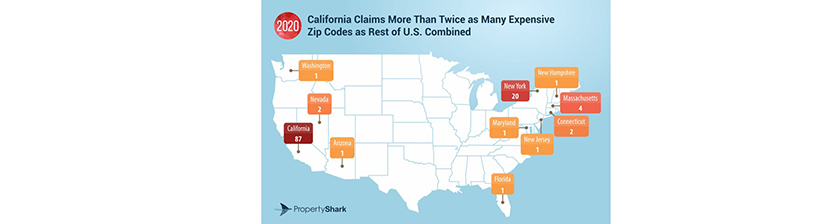

Property Shark Lists 100 Priciest Zip Codes

Property Shark, New York, released its annual ranking of the 100 priciest zip codes in the US by closed home sales. Eight-seven of the 100 priciest zips were in California, with Atherton, Calif., a Silicon Valley suburb, leading the pack for the fourth year in a row at $7 million, followed by Sagaponack, N.Y., for the second consecutive year.

Due to several ties, the ranking includes a total of 121 zip codes.

In 78 of the 100 priciest zips in the US, medians have been on the rise in 2020, flipping the mostly downsliding trend of 2019. The San Francisco Bay Area accounts for 50 of the pricey housing markets, with 11 of them concentrated in San Francisco alone. The most exclusive county in the U.S., L.A. County has 23 zips in the top 100 this year.

Besides California and New York, nine other states contributed with at least one zip code each (https://www.propertyshark.com/Real-Estate-Reports/most-expensive-zip-codes-in-the-us).

Redfin: Home Sales Surge 24%, Biggest Gain on Record; Prices up 14% in October

Redfin, Seattle, said the national median home price posted its second-largest annual increase on record in October, rising by 14.2% year over year to $335,900. Home sales surged 24% from a year earlier—the largest gain on record—while new listings were up just 12%.

“October very well may have been the hottest the housing market gets this year,” said Redfin chief economist Daryl Fairweather. “Buyers who stepped away from the market at the beginning of the pandemic had been making up for lost time, which sent prices skyrocketing. But given that we are entering a winter wave of the pandemic, housing demand will likely lose a bit of steam until 2021, cooling the market from red-hot to just hot. If you are a seller, it’s probably a good idea to wait until the new year to list your home, but if you are a buyer, right now is a short window of opportunity where competition likely won’t be as intense as it was in October.”

Median prices increased in all but one of the 85 largest metro areas Redfin tracks. The only metro area where prices fell from a year earlier was Honolulu (-0.8%). The largest price increases were in Bridgeport, Conn., (+39%), Memphis, Tenn. (+30%) and Newark, N.J. (+24%).

Zillow: Home Values Rising at Fastest Rate Since 2005

Zillow, Seattle, said a market defined by intense demand for relatively tight supply pushed month-over-month and quarterly home value growth to levels not seen since 2005.

The company’s monthly Real Estate Market Report also said rent appreciation is steaming ahead in many Midwest and Sun Belt cities while declining in major coastal metros.

Home value growth accelerated from 0.9% month over month growth in September to 1% in October, the fastest rate in 15 years. That growth has only been higher — barely — on four occasions in the 24-year history of the Zillow Home Value Index: in June, July, August, and September of 2005. Typical home values now stand at $262,604.

“The red-hot housing market of this summer and fall is now clearly reflected in soaring home value appreciation,” said Zillow senior economist Jeff Tucker. “We haven’t seen such steep, short-term appreciation since the summer of 2005, but this time it is driven by buyers with strong credit and incomes securing affordable fixed-rate mortgages, unlike the wave of poorly-vetted, exotic mortgages that financed the last boom. The simple fact is that millions of well-qualified Millennials are seriously shopping for houses and they are competing for a shortfall of homes for sale.”

Redfin: October Demand for Second Homes Surges 100% Year Over Year

Sales of vacation homes are soaring, even as millions of Americans grapple with financial devastation triggered by the coronavirus pandemic, said Redfin, Seattle. In October, demand for second homes skyrocketed 100% from a year earlier—the fourth triple-digit increase in the last five months. That outpaced the 50% increase in demand for primary homes.

Home sales are on the rise across the board due to record-low mortgage rates and a wave of relocations during the pandemic, but demand for second homes is particularly strong as affluent Americans work remotely, no longer need to send their kids to school in person and face travel restrictions, explained Redfin lead economist Taylor Marr.

Marr added some of the second homes purchased this year will ultimately turn into primary homes, as it’s not uncommon for a buyer to close a deal on a second home before putting their current house on the market.

“With mortgage rates at all-time lows and offices shut down across the country, the dream of having a second home outside of the city is becoming a reality for many wealthy Americans,” Marr said. “Unfortunately, at the same time, millions of less-fortunate families are behind on their mortgage or rent payments due to financial hardship brought on by the coronavirus pandemic.”

Freddie Mac: Forbearance Has Helped Mitigate Damage to Homeowners During Pandemic

Freddie Mac, McLean, Va., said without forbearance, many households may have defaulted or been forced to sell their homes during the COVID-19 pandemic. These forced sales could have depressed the housing market, leading to further defaults.

“Mortgage forbearance provides liquidity to households and plays a vital role in mitigating the damage to homeowners during times of crisis whether it be a hurricane, wildfire or health epidemic,” said Freddie Mac Chief Economist Sam Khater.

The report noted while loans with high loan-to-value ratios are more likely to be in forbearance, nearly all loans in forbearance have positive equity. Forbearance rates decline for borrowers with higher FICO scores.

Radian: U.S. Home Prices Kick Off 4th Quarter with Slightly Slower Gains

Radian, Philadelphia, said after a very strong third quarter, home prices across the United States continued to climb in October albeit at a slower rate than in September, rising 7.5 percent in the 12 months since November.

Redfin said since the start of the year, the estimated median home price has increased by an absolute, not annualized, rate of 6.7 percent, which was higher than the increase recorded in the same period of 2019. The monthly annualized increase recorded in October, while slower than September, was still the second-best appreciation month in 2020.

“The end of the traditional summer season has collided headfirst into the second wave of COVID-19 across the U.S. As such, we would expect that the coming months, similar to the initial wave, will show slowing appreciation rates for homes,” said Steve Gaenzler, Radian Senior Vice President of Data and Analytics. “Lessening demand for housing due to typical seasonal patterns may reduce pressures seen through the first ten months of 2020, however, without active supply increases home prices should continue to grow.”

The report said nationally, the median estimated price for single-family and condominium homes rose to $264,585. Since the start of 2020, the median estimated home price in the U.S. has increased more than $16,667. By region, median home estimates are more than $30,000 higher in the West region than they were at the end of 2019; the highest dollar gain so far this year. Prices in the MidAtlantic region are higher by a lesser, $12,200 over the same period, representing the least absolute gain by a region.

Black Knight First Look: Delinquencies Fall for 5th Straight Month

Black Knight, Jacksonville, Fla., said mortgage delinquencies improved again in October, falling to 6.44%, the lowest level since March.

However, the company’s First Look Mortgage Monitor noted despite five consecutive months of improvement, there are still more than 3.4 million delinquent mortgages, nearly twice as many as there were entering the year.

The report said serious delinquencies – loans 90 or more days past due – improved in October as well, but volumes remain at more than five times (+1.8 million) pre-pandemic levels. October’s 4,700 foreclosure starts marked a nearly 90% year-over-year reduction as widespread moratoriums remain in place, while active foreclosure inventory set yet another record low at 178,000.

Black Knight said record-low interest rates again pushed prepayment activity higher, with October’s prepayment rate of 3.17% setting the highest single-month mark in more than 16 years.