FundingShield, Newport Beach, Calif., released its Q2 2025 Wire Fraud Analytics and Risk Report, finding 46.63% of transactions were flagged for issues that posed a significant risk of wire and title fraud.

Tag: Wire Fraud

FundingShield Finds Fraud Risk Still High in Q2

FundingShield, Newport Beach, Calif., released its second-quarter report, finding that 47.08% of transactions in a $74 billion portfolio including residential, commercial and business purpose loans presented some risk.

FundingShield: Fraud Risk Still High in Q2

FundingShield, Newport Beach, Calif., released its second-quarter report, finding that 47.08% of transactions in a $74 billion portfolio including residential, commercial and business purpose loans presented some risk.

FundingShield: Q1 Wire, Title Fraud Risk Remains High

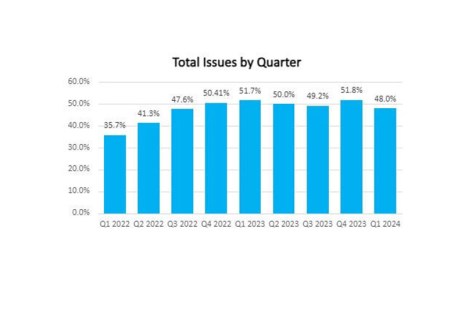

FundingShield, Newport Beach, Calif., reported that wire and title fraud risk dropped somewhat from record-breaking levels hit in the fourth quarter of 2023, but 48% of loans processed in the quarter still exhibit at least one risk factor.

FundingShield: Q4 2023 Analytics Show Significant Risk for Wire, Title Fraud

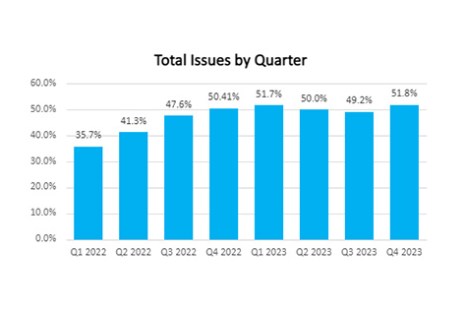

FundingShield, Newport Beach, Calif., reported wire and title fraud risk reached a high of 51.8% of loans on a $61 billion portfolio having at least one risk issue in the fourth quarter.

Regina M. Lowrie, CMB, of Dytrix on How Lenders Can Protect Against Cyberfraud

Regina M. Lowrie, CMB, is President and CEO of Dytrix, a fintech company that enables secure financial transactions for institutions through the Dytrix Platform, which includes wire/ACH transfer validation and closing agent management. In 2005, she became the first woman Chair of the Mortgage Bankers Association and continues to serve on many MBA committees.

Regina M. Lowrie, CMB, of Dytrix on How Lenders Can Protect Against Cyberfraud

Regina M. Lowrie, CMB, is President and CEO of Dytrix, a fintech company that enables secure financial transactions for institutions through the Dytrix Platform. She has more than 30 years of experience in the financial services industry and has established and managed multiple successful banking/lending organizations. In 2005, she became the first woman Chair of the Mortgage Bankers Association and continues to serve on many MBA committees.

Regina M. Lowrie, CMB, of Dytrix on How Lenders Can Protect Against Cyberfraud

Regina M. Lowrie, CMB, is President and CEO of Dytrix, a fintech company that enables secure financial transactions for institutions through the Dytrix Platform. In 2005, she became the first woman Chair of the Mortgage Bankers Association and continues to serve on many MBA committees.

Regina M. Lowrie, CMB, of Dytrix on How Lenders Can Protect Against Cyberfraud

Regina M. Lowrie, CMB, is President and CEO of Dytrix, a fintech company that enables secure financial transactions for institutions through the Dytrix Platform, which includes wire/ACH transfer validation and closing agent management. In 2005, she became the first woman Chair of the Mortgage Bankers Association and continues to serve on many MBA committees.

Regina M. Lowrie, CMB, of Dytrix on How Lenders Can Protect Against Cyberfraud

Regina M. Lowrie, CMB, is President and CEO of Dytrix, a fintech company that enables secure financial transactions for institutions through the Dytrix Platform, which includes wire/ACH transfer validation and closing agent management.