FundingShield: Q1 Wire, Title Fraud Risk Remains High

(Image courtesy of FundingShield; Breakout image courtesy of Aathif Aarifeen/pexels.com)

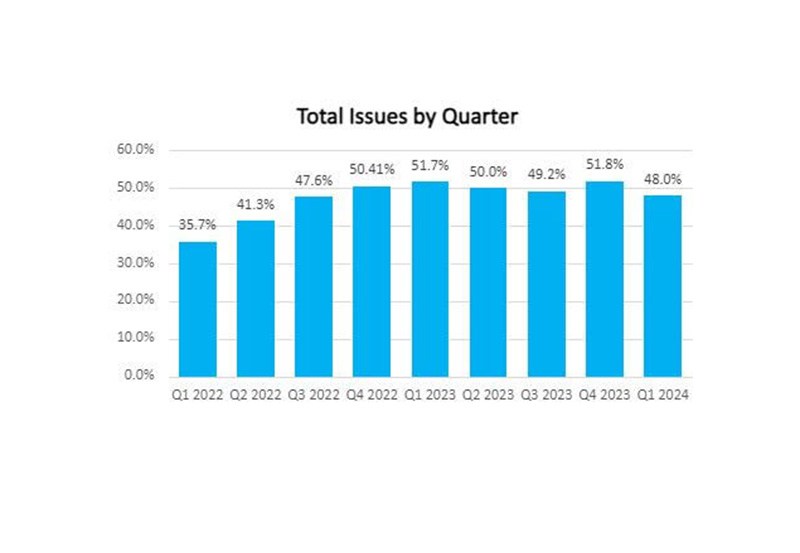

FundingShield, Newport Beach, Calif., reported that wire and title fraud risk dropped somewhat from record-breaking levels hit in the fourth quarter of 2023, but 48% of loans processed in the quarter still exhibit at least one risk factor.

The number was at 51.8% in the fourth quarter, and 51.7% in the first quarter of 2023.

FundingShield analyzed a $65 billion portfolio including residential, commercial and business purpose loans for wire and title fraud.

On average, problematic loans had 2.22 issues per loan.

In particular, high risk levels for wire data and CPL validations were recorded. That includes issues such as agent good standing, data accuracy between lenders and title systems, and agent registration/active status.

However, FundingShield noted seasonal trends related to license and insurance renewals may have affected those numbers.

CPL issues were present on 44.6% of transactions, CPL Validation issues on 9.8% of transactions and wire risks on 9.2% of transactions.

These numbers come amid an environment in which attention on cybersecurity remains high.

“At a recent CEO roundtable where FundingShield presented to bank and IMB CEOs of mortgage companies or mortgage lending units within banks, 60%+ of the CEOs said they had been informed of increased threat activity or attempts by bad actors to hack into their system during Q1 where bank and wire information is stored ahead of or during funding,” said Ike Suri, FundingShield CEO.