The Mortgage Bankers Association sent a letter to House Veterans Affairs Committee leadership May 6, expressing support for the VA Home Loan Program Reform Act, or H.R. 1815.

Tag: VA

MBA Calls on VA, Congress to Implement Permanent Partial Claim Program to Assist Veteran Homeowners at Risk of Foreclosure

MBA President and CEO Bob Broeksmit, CMB, commented on the Department of Veterans Affairs’ reported plans of a phase-out of its Veterans Affairs Servicing Purchase program.

Carrington Mortgage Services’ Elizabeth Balce Testifies on VA Home Lending

Elizabeth Balce, Executive Vice President of Servicing, Carrington Mortgage Services, testified Tuesday at a legislative hearing before the Committee on Veterans’ Affairs Subcommittee on Economic Opportunity.

To the Point With Bob–Mortgage Servicers: Diligently Serving Borrowers Through Constant Change

Mortgage servicers have a vital function in the mortgage market and the wider economy, writes MBA President and CEO Bob Broeksmit, CMB.

MBA: May New Home Purchase Mortgage Applications Increased 13.8%

The Mortgage Bankers Association Builder Application Survey data for May 2024 shows mortgage applications for new home purchases increased 13.8% compared to a year ago. Compared to April 2024, applications increased by 1%.

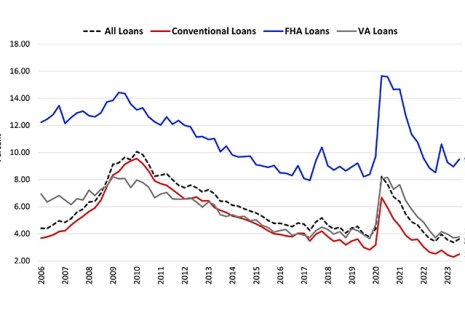

MBA Chart of the Week: Delinquency Rates by Loan Type, Conventional, FHA, VA

According to the latest MBA National Delinquency Survey, the overall delinquency rate for mortgage loans on one‐to‐four‐unit residential properties increased to 3.62% of all loans outstanding at the end of the third quarter of 2023.

(#MBAServicing23) Government Agencies Stress Flexibility

ORLANDO—Representatives of government agencies here at the Mortgage Bankers Association’s Servicing Solutions Conference & Expo stressed their agility in addressing key issues facing mortgage servicers.

(#MBAServicing23) Government Agencies Stress Flexibility

ORLANDO—Representatives of government agencies here at the Mortgage Bankers Association’s Servicing Solutions Conference & Expo stressed their agility in addressing key issues facing mortgage servicers.

Biden Administration Extends, Expands Forbearance/Foreclosure Relief Programs

The Biden Administration today announced a coordinated extension and expansion of forbearance and foreclosure relief programs. The programs, set to expire at the end of March, have now been extended through June 30.

Industry Briefs Sept. 18, 2020

ACES Risk Management (ARMCO), Denver, a provider of management and control software for the financial services industry, completed its rebranding effort to align the company’s image with its expanded focus on quality and risk management for banks and credit unions, as well as independent mortgage lenders.