The Mortgage Bankers Association and National Fair Housing Alliance announced a new online toolkit for mortgage lenders interested in developing Special Purpose Credit Programs, which permit lenders to offer mortgage credit to economically and socially disadvantaged borrowers and are an important tool for ensuring financial institutions can meet the needs of their consumers.

Tag: Underserved Borrowers

George Baker of Talk’uments: In Spite of Storm Clouds, Genuine Opportunities Emerging for Lenders

The virtually untapped and growing market of Limited English Proficiency borrowers deserves consideration and investment, and promises real potential for lenders which do.

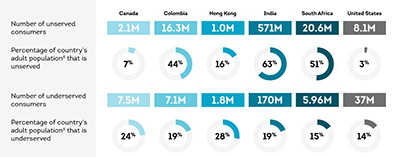

TransUnion: More than 45 Million Americans Credit Unserved or Underserved

More than 45 million consumers are considered to be either credit unserved or underserved in the United States, according to a new global TransUnion stud

CFPB Issues Interpretive Rule on Determining Underserved Areas; Final Rule on Loss Mitigation Options for Homeowners with COVID-Related Hardships

The Consumer Financial Protection Bureau yesterday issued an interpretive rule to provide guidance to creditors and other persons involved in the mortgage origination process about the way in which the Bureau determines which counties qualify as “underserved” for a given calendar year.

Parkes Dibble: Working with Self-Employed and Underserved

Today, mortgage lenders are almost as likely to meet a potential homebuyer who is self-employed, or part of the gig economy. According to a study from the Freelancers Union Freelancing in America: 2019, 57 million Americans—or 35 percent of the US workforce-are self-employed.