John Edward Bell III, a longtime executive at the U.S. Department of Veterans Affairs, passed away on October 29, 2025.

Tag: U.S. Department of Veterans Affairs

ICE First Look: Foreclosure Activity Creeps up

Intercontinental Exchange Inc., Atlanta, released its First Look at April 2025 data, finding that the national delinquency rate is up to 3.22%–up 1 basis point from March and 13 basis points from April 2024.

MBA Statement on the Veterans Affairs Voluntary Foreclosure Moratorium

MBA’s President and CEO Bob Broeksmit, CMB, released a statement on the Department of Veterans Affairs’ (VA) voluntary foreclosure moratorium.

MISMO Releases Standardized Dataset for Efficient Exchange of VA Verification of Benefits Information

MISMO®, the real estate finance industry’s standards organization, announced that the industry standard dataset mapping for the U.S. Department of Veterans Affairs (VA) Verification of VA Benefits (Form 26-8937) has reached “Candidate Recommendation” status, which means it has been thoroughly reviewed by a wide range of organizations and industry participants and is available for use across the industry.

MISMO Releases Standardized Dataset for Efficient Exchange of VA Verification of Benefits Information

MISMO®, the real estate finance industry’s standards organization, announced that the industry standard dataset mapping for the U.S. Department of Veterans Affairs (VA) Verification of VA Benefits (Form 26-8937) has reached “Candidate Recommendation” status, which means it has been thoroughly reviewed by a wide range of organizations and industry participants and is available for use across the industry.

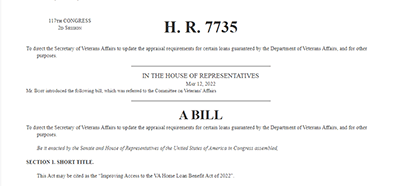

MBA Commends House Passage of VA Appraisal Modernization Legislation

The House yesterday passed H.R. 7735, the Improving Access to the VA Home Loan Benefit Act of 2022. The Mortgage Bankers Association commended its passage.

MBA Weighs In to Support Improving Access to the VA Home Loan Benefit Act

The Mortgage Bankers Association supports modernizing and streamlining the homebuying process for our nation’s veterans, including efforts related to home appraisals, MBA told Members of Congress.

House Passes MBA-Opposed Bill Expanding Servicemember Educational Assistance

The House on Wednesday passed a bill opposed by the Mortgage Bankers Association and other industry trade groups that would expand eligibility for servicemember educational assistance, but also impose fees that would translate into higher costs for veterans.

MBA Advocacy Spurs Crackdown on Deceptive VA Loan Marketing

The settlements signal a remarkable effort by the Consumer Financial Protection Bureau to hold lenders accountable for their dealings with the nation’s veterans—and the culmination of advocacy by the Mortgage Bankers Association to protect earned benefits for servicemembers, veterans and surviving spouses.

MBA Advocacy Spurs Crackdown on Deceptive VA Loan Marketing

The settlements signal a remarkable effort by the Consumer Financial Protection Bureau to hold lenders accountable for their dealings with the nation’s veterans—and the culmination of advocacy by the Mortgage Bankers Association to protect earned benefits for servicemembers, veterans and surviving spouses.