MBA Weighs In to Support Improving Access to the VA Home Loan Benefit Act

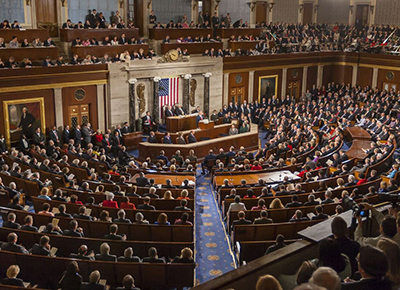

The Mortgage Bankers Association supports modernizing and streamlining the homebuying process for our nation’s veterans, including efforts related to home appraisals, MBA told Members of Congress.

“While the role of mortgage lenders in the appraisal process is limited by design, MBA and its members are committed to working with policymakers and other stakeholders, including appraisers, to develop solutions that ensure borrowers receive a timely and accurate estimate of the value of their home,” MBA Senior Vice President of Legislative and Political Affairs Bill Killmer said in a letter to Reps. Mark Takano, D-Calif., and Mike Bost, R-Ill. in support of H.R. 7735, the Improving Access to the VA Home Loan Benefit Act of 2022.

Takano and Bost serve as Chairman and Ranking Member of the House Committee on Veterans’ Affairs, respectively. MBA also sent the letter to Reps. Mike Levin, D-Calif., and Barry Moore, R-Ala., the Chairman and the Ranking Member, respectively, of the House Subcommittee on Economic Opportunity.

“Improving the process by which appraisals for loans guaranteed by the Department of Veterans Affairs are conducted holds the potential to lower costs for veterans seeking to buy a home and make their offers more attractive in a highly competitive housing market,” Killmer said. “Reforms that achieve these objectives, therefore, can open access to more affordable, sustainable homeownership opportunities for active and retired servicemembers throughout the country.”

In May, MBA Vice Chair Mark A. Jones testified in support of H.R. 7735 on behalf of MBA before the House VA Subcommittee on Economic Opportunity. Jones is also CEO and Co-Founder of Amerifirst Home Mortgage, a privately held, independent residential mortgage lender based in Kalamazoo, Mich. He said VA home loans represent one of the most important benefits our nation’s veterans earn through their selfless service to our country.

The letter said H.R. 7735 would encourage important reforms to the VA requirements regarding when an appraisal is necessary, how appraisals are conducted and who is eligible to conduct an appraisal. “By directing the VA to examine updates to its existing rules and program guidelines, the legislation is a first step towards broad modernization of VA appraisal processes,” MBA said. “First, the legislation directs VA to review appraiser certification requirements. Given the significant shortage of appraisers across the country, this review will provide an opportunity to responsibly expand the list of those eligible to conduct appraisals for VA-guaranteed transactions. This process improvement, in turn, should address delays in appraisal turn times and alleviate home seller concerns about borrowers using VA loans.”

H.R. 7735 also would encourage VA to provide more clarity regarding its Assisted Appraisal Processing Program, which supplements the traditional appraisal process and has the potential to lower costs and reduce turn times by permitting individuals other than appraisers to collect property information, MBA noted. “This is a promising alternative to traditional appraisals, though lenders and appraisers need additional guidance for it to achieve its full benefits,” Killmer said. “The legislation would direct VA to revisit its policies on minimum property requirements, the selection and review of comparable sales, and quality control measures – each of which could streamline the appraisal process and encourage broader participation in the VA Home Loan program. These process improvements would further reduce hurdles to home sellers accepting offers from borrowers using VA loans.”

Finally, H.R. 7735 provides an opportunity for VA to explore the use of waivers or other alternatives to traditional appraisals (such as desktop appraisals or expanded use of Automated Valuation Models), MBA said. While VA will determine whether such alternatives are appropriate for VA-guaranteed lending, this analysis is an important component of modernizing its processes to create an improved experience for veteran homebuyers.

“In conclusion, and for all the foregoing reasons, MBA strongly supports H.R. 7735,” Killmer said, noting MBA hopes to work with Congress to make the VA Home Loan program as efficient and effective as possible.