A new TransUnion study analyzes the creditworthiness of the LMI consumer segment and how lenders can grow market share and revenue.

Tag: TransUnion

CFPB Analysis Criticizes Consumer Reporting Companies on Complaint Response

A new Consumer Financial Protection Bureau analysis sharply criticized the three major nationwide consumer reporting companies, alleging changes in complaint responses provided by Equifax, Experian and TransUnion resulted in fewer meaningful responses and less consumer relief.

Housing Market Roundup: Dec. 21, 2021

So many reports, so little time. Here’s a roundup of recent housing market reports that came across the MBA NewsLink desk:

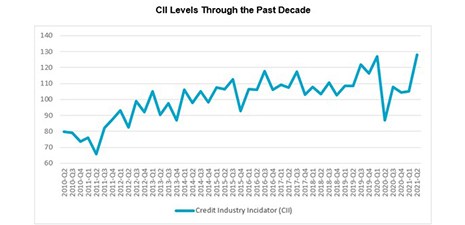

Gen Z Drives Strong Q3 Credit Activity

The credit card industry is rebounding strongly from the early impacts of the COVID-19 pandemic, said TransUnion, Chicago, with Gen Z leading the way in terms of originations and bankcard balance growth and other credit categories, including mortgage.

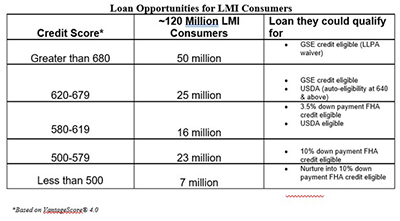

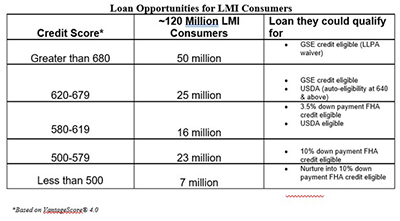

TransUnion: LMI Consumers Present $300 Billion Growth Opportunity for Mortgage Industry

Low-to-moderate income consumers have traditionally been overlooked in the mortgage market and trail non-LMI consumers in terms of homeownership. A new study from TransUnion, Chicago, suggests closing this gap could yield mortgage lenders as much as ~$300 billion in refinance and purchase originations.

TransUnion: LMI Consumers Present $300 Billion Growth Opportunity for Mortgage Industry

Low-to-moderate income consumers have traditionally been overlooked in the mortgage market and trail non-LMI consumers in terms of homeownership. A new study from TransUnion, Chicago, suggests closing this gap could yield mortgage lenders as much as ~$300 billion in refinance and purchase originations.

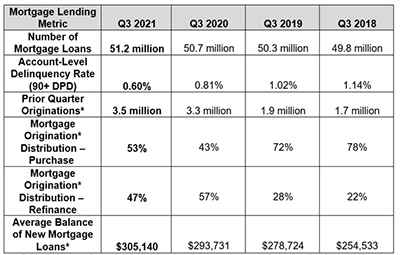

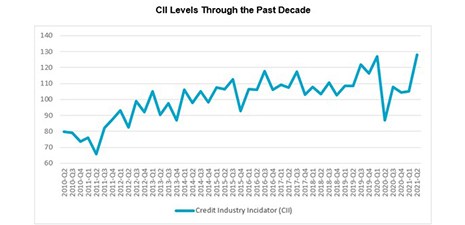

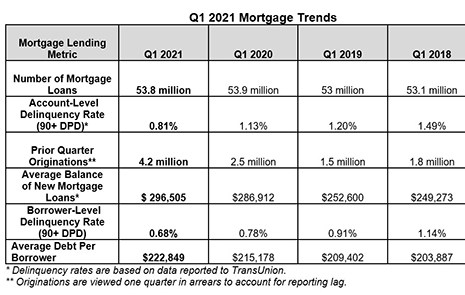

TransUnion: Healthy Consumer Credit Market Drives Return to Lending

TransUnion, Chicago, said the financial services industry is rebounding strongly from the early impacts of the COVID-19 pandemic, with auto, credit card, mortgage and personal loan industries exhibited renewed signs of strength at the mid-point of 2021.

TransUnion: Healthy Consumer Credit Market Drives Return to Lending

TransUnion, Chicago, said the financial services industry is rebounding strongly from the early impacts of the COVID-19 pandemic, with auto, credit card, mortgage and personal loan industries exhibited renewed signs of strength at the mid-point of 2021.

TransUnion: Majority of Consumers in Accommodation Programs Continue to Make Payments

Enrollment in financial hardship programs grew significantly as a result of the COVID-19 pandemic – to 7% of all accounts for credit products such as auto loans and mortgages. However, a new TransUnion study reported the majority of consumers continued to make payments on their accounts, even when in an accommodation program.

TransUnion: Consumer Credit Performance Improving, Demand Increasing

TransUnion, Chicago, said despite shockwaves felt from the COVID-19 pandemic, the consumer credit market is strongly positioned as many parts of the country prepare to enter new phases of re-opening this summer.