TransUnion: Mortgage Balances Remain Near Record Highs; More Consumers Turn to Home Equity Loans

(Courtesy TransUnion)

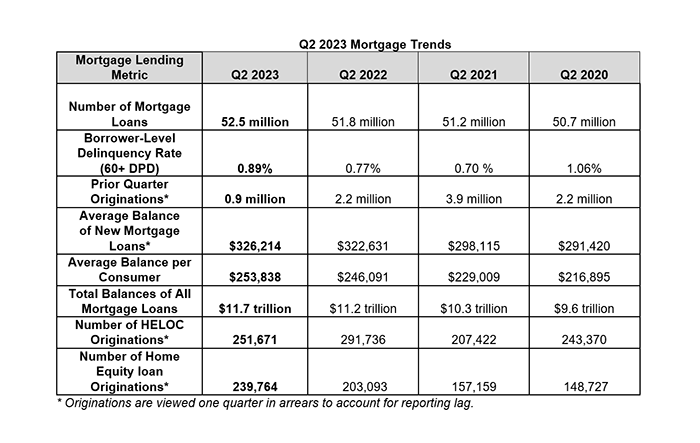

TransUnion, Chicago, said total mortgage balances fell to $11.7 trillion in the second quarter, down slightly from last quarter’s record high but up 4.3% year-over-year.

This slight decrease represented the first quarterly decline in total mortgage balances since 2015, TransUnion’s Credit Industry Insights Report said.

Mortgage originations also declined, falling to 899,000 in the first quarter, down 59% year-over-year from a year ago. “This represents the second-largest annual decline on record,” TransUnion said. Purchases made up 87% of first-quarter volume with 780,000 originations (down by 40% year-over-year from 1.3 million in Q1 2022).

Overall refinance volume was down by 86% from 870,000 a year ago to 121,000 in second-quarter 2023. Rate and term refinance originations decreased 93% year-over-year, down from 305,000 in Q1 2022 to just 23,000 in Q1 2023. This marks the third consecutive quarterly record low. Cash-out refinance originations also fell to a new record low in Q1 2023, down 83% year-over-year from 565,000 to 98,000. Home equity originations remain in line with last year’s historically high levels, with home equity line of credit originations falling 14% year-over-year to 252,000 in Q1 2023 but with home equity loan originations up 18% (from 203,000 to 240,000) over the same period.

Mortgage delinquencies displayed a slight year-over-year increase, with 60-plus days past due delinquencies rising 14% to 0.96% in Q2 2023, representing the fifth consecutive quarter of year-over-year increases but still below pre-pandemic levels.

“Mortgage rates higher than those in recent history continue to lend pause to potential borrowers, resulting in historically low mortgage originations,” said Joe Mellman, senior vice president and mortgage business leader at TransUnion. “Demand for refinance continues to be the hardest hit by these elevated rates. Given that the large majority of existing mortgages have rates below 6%, there is no incentive for homeowners to refinance their existing lower-than-current-rates mortgage and enter into a new, costlier mortgage.”

But Mellman noted that among those who have refinanced, the vast majority–81%–opted for cash-out, indicating consumers remain interested in tapping into the equity in their homes. “It remains to be seen if an expected moderation in mortgage rates in the second half of 2023 could potentially result in an uptick in refinance activity,” he said. “Home equity products continue to remain viable options for consumers looking to utilize their tappable equity to pay down higher interest debt, with consumer interest in home equity loans in particular, on the rise this year.”

Mellman said delinquency levels remain below historical norms despite a fifth consecutive quarterly increase. “This remains a trend worth watching particularly as we continue to observe the effects of inflation on consumers’ wallets,” he said.