Twenty million single-family homes are at high risk from severe convective storms, reported CoreLogic, Irvine, Calif.

Tag: Tom Larsen

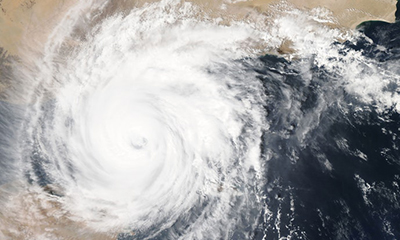

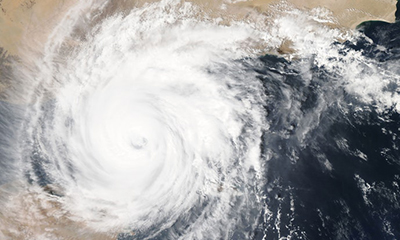

CoreLogic: Insured, Uninsured Damages for Hurricane Ian at $41-$70 Billion

CoreLogic, Irvine, said final damage estimates for Hurricane Ian could run as high as $70 billion—of which up to $17 billion could be uninsured.

Housing Market Roundup Sept. 15, 2022

Here’s a quick summary of recent housing market reports that have come across the MBA NewsLink desk:

CoreLogic Report Finds Idaho, Wyoming at Disproportionate Economic Risk for Wildfire

You’d think that when analyzing wildfire risk, California would be at the top. But a CoreLogic analysis of additional factors, such as reconstruction resources and economic recovery potential, found that Idaho and Wyoming are the states at most risk.

CoreLogic: Hurricane Ida Leaves $27-40 Billion in Losses

CoreLogic, Irvine, Calif., estimated residential and commercial wind, storm surge and inland flooding loss estimates for Hurricane Ida in Louisiana, Mississippi and Alabama at $27-$40 billion.

CoreLogic: Nearly 2 Million Homes at Elevated Risk of Wildfire Damage

The report said 1,975,116 homes in the United States with an associated reconstruction cost of more than $638 billion at elevated risk of wildfire damage. These homes represent 6.5% of the total number of U.S. homes.

CoreLogic: Serious Delinquency Rates Triple in Recent Disaster Areas

CoreLogic, Irvine, Calif., released its annual Natural Hazard Report, saying communities affected by wildfire, hurricanes, tornadoes, earthquakes and other natural disasters in 2019 will likely experience an increase in mortgage delinquency rates, taking 12 or more months before normalizing to pre-disaster rates.