CoreLogic: Insured, Uninsured Damages for Hurricane Ian at $41-$70 Billion

CoreLogic, Irvine, said final damage estimates for Hurricane Ian could run as high as $70 billion—of which up to $17 billion could be uninsured.

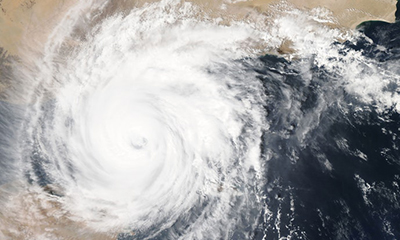

Ian, which had earlier done extensive damage to Cuba, made landfall in south Florida on Sept. 28 as a Category 4 hurricane with sustained winds of 145 miles per hour. After devastating parts of south and central Florida, Ian downgraded to a tropical storm before reforming over the Atlantic as a Category 1 hurricane, causing additional damage to South Carolina, North Carolina and Virginia. More than 120 people were confirmed dead in Florida as a direct result of Ian.

According to new data analysis, CoreLogic estimated total flood and wind losses at between $41 billion and $70 billion. This estimate includes wind loss, re-evaluated insured and uninsured storm surge loss and newly calculated inland flood loss for residential and commercial properties. Flood loss from NFIP and private insurance for residential and commercial properties is estimated to be between $8 billion and $18 billion, which includes both re-evaluated storm surge and new estimates for inland flooding. Uninsured flood loss for this area is estimated to be between $10 billion and $17 billion. Wind losses are estimated to be $23 billion to $35 billion.

CoreLogic noted inland flooding was extreme due to significant riverine flooding along Peace River in Arcadia, Fla., located south of Tampa and north of Punta Gorda. Peace River, which normally runs 130 feet wide, flooded to more than a mile wide due to Hurricane Ian surge and rainfall. However, this area is designated as a Special Flood Hazard Area by FEMA and housing is sparse in this location.

“In many areas the flood extent approximates the SFHA boundaries, a clear indication that SFHA is a useful tool for city planners who wish to understand flood risk and mitigate flood damages,” said Tom Larsen, senior director of Hazard and Risk Management with CoreLogic. “Without constraints in development in the SFHA, flood damages would have skyrocketed. Learning from this riverine flood event will help city planners make better decisions about where residential development makes sense, from standard construction homes to manufactured home communities.”

The report also noted Ian’s large wind field and landfall path caused severe wind and coastal storm surge damage along the densely populated coast. “The key reason Hurricane Ian is so economically destructive is due to the massive growth in coastal real estate in Florida,” Larsen said. “Florida’s population has grown 50% since 1992 when Hurricane Andrew hit Miami, with disproportionately more growth in South Florida. The extra costs incurred from the surge in repair needs simultaneous with a fragile economy are headwinds to rapid reconstruction and we should expect to see resident displacement and housing affordability issues in the state for some time to come.”

CoreLogic said Florida had been a primary destination in the great migration trend of 2020 and 2021 due to the state’s lack of income tax and housing with lower cost per square foot than homes in major coastal metros such as New York City and San Francisco. Additionally, residents have enjoyed increasing home equity gains throughout 2022, with homeowners reaching an average equity record-high of nearly $300,000.

Selma Hepp, interim lead of the Office of the Chief Economist with CoreLogic, said disasters such as Ian, however, could put a damper on the state’s housing growth.

“Housing markets in Florida will face difficult times as many Florida residents have been impacted by the devastating storm,” Hepp said. “Initially, we are likely to see an increase in mortgage delinquencies as is typical following catastrophes. Also, rents are likely to jump as households who lost their home seek immediate shelter. Longer term, home price growth in hard hit areas is likely to lag that of the rest of the state and nation as people may opt to move to areas less prone to natural disasters.”

According to CoreLogic, more than 66,000 pending mortgage applications worth nearly $22.5 billion are currently in progress in Florida, North Carolina and South Carolina and are in jeopardy from Hurricane Ian damages.