Trepp, New York, reported its CMBS Special Servicing Rate rose in September, up 33 basis points to 8.79%.

Tag: Special Servicing

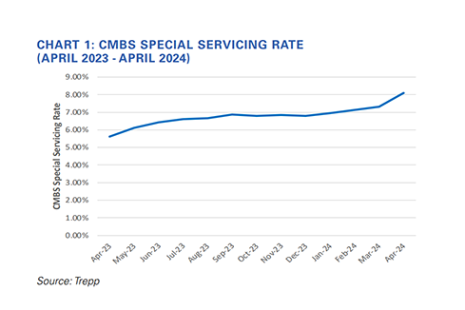

Trepp: CMBS Special Servicing Rate Jumps in April

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate “leaped” in April, rising 80 basis points to reach 8.11%.

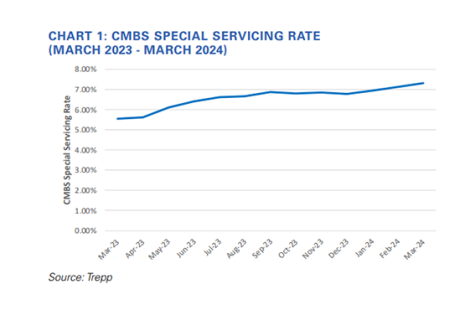

CMBS Special Servicing Rate Jumps: Trepp

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate jumped 17 basis points in March to 7.31%.

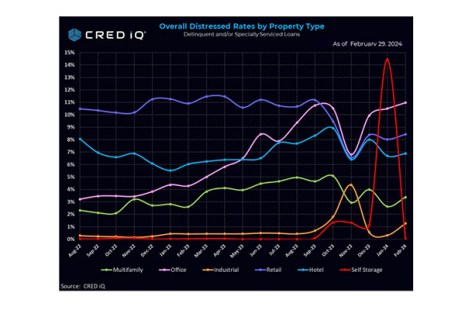

CRED iQ: Multifamily Distress Rate Up 80 Basis Points in February

CRED iQ, Wayne, Pa., reported the Distress Rate for all property types trimmed 4 basis points in February to 7.35%. However, the multifamily distress rate was up 80 basis points–the largest monthly increase in that sector in more than a year and a half.

MBA NewsLink Roundtable: Top Commercial Mortgage Servicing Issues to Watch in 2024

With the logjam in the commercial real estate transaction market top of mind for many, loan servicing and asset management professionals entered the new year with a fresh set of opportunities and challenges defined not by a flood of new originations but the expectation of a growing supply of troubled loans.

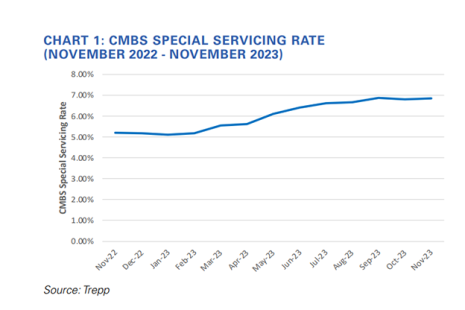

CMBS Special Servicing Rate Ticks Upward in November: Trepp

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate increased 4 basis points in November to 6.84%.

Trepp: Special Servicing Rate Climbs in September

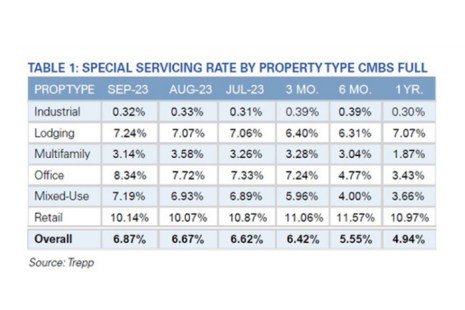

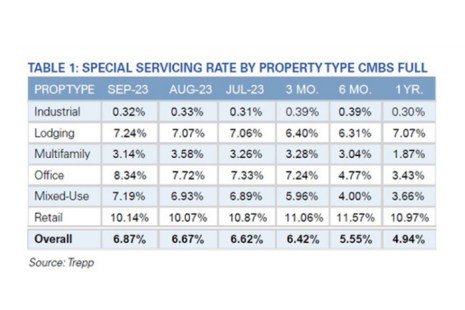

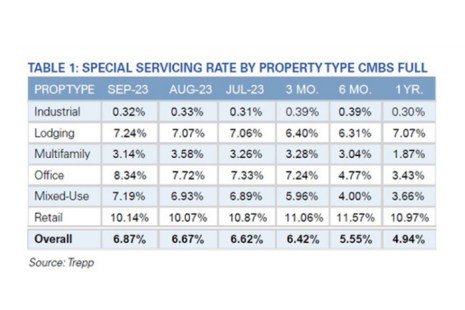

Trepp, New York, reported the CMBS Special Servicing Rate increased by 20 basis points in September, up to 6.87%.

Trepp: Special Servicing Rate Climbs in September

Trepp, New York, reported the CMBS Special Servicing Rate increased by 20 basis points in September, up to 6.87%.

Trepp: Special Servicing Rate Climbs in September

Trepp, New York, reported the CMBS Special Servicing Rate increased by 20 basis points in September, up to 6.87%.

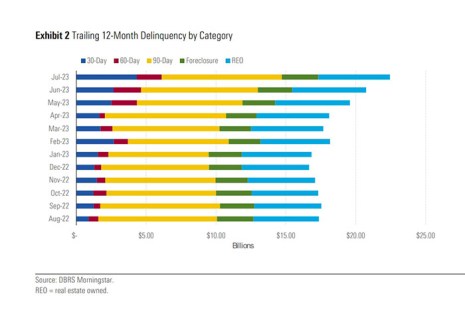

DBRS Morningstar: CMBS Delinquency Rate Surges

DBRS Morningstar, Toronto, reported the delinquency rate for loans packaged in commercial mortgage-backed securities surged 31 basis points in July. The special servicing rate rose for the fifth straight month, increasing 24 basis points during July.