SAN DIEGO–Amid rising premiums and natural disasters, it’s no surprise that insurance is a big concern for the multifamily industry. With that in mind, the Federal Housing Finance Agency’s Siobhan Kelly announced the agency will hold a multifamily insurance symposium March 13–with both in-person and virtual options–to brainstorm solutions to insurance issues.

Tag: Servicing

MBA Releases 2023 Year-End Commercial/Multifamily Servicer Rankings–#MBACREF24

SAN DIEGO–The Mortgage Bankers Association released its year-end ranking of commercial and multifamily mortgage servicers’ volumes as of December 31, 2023, at its 2024 Commercial/Multifamily Finance Convention and Expo.

LERETA’s John Walsh: Higher Taxes and Insurance Will Surprise Borrowers with Escrow Accounts in 2024. Are Servicers Ready?

While homeowners across the U.S. are celebrating the record-high appreciation in their home values and, as a result, their home equity, servicers are preparing for the other shoe to drop: an accompanying rise in real estate taxes, affecting escrow balances and creating issues for both borrowers and servicers.

ATTOM: California, New Jersey, Illinois Have Highest Concentrations of At-Risk Markets

California, New Jersey and Illinois have the highest concentrations of the most-at-risk markets in the country, according to ATTOM, Irvine, Calif.

MBA Newslink Q&A: Toby Wells, President of Cornerstone Servicing

MBA NewsLink interviewed Cornerstone Servicing President Toby Wells about technology advances that improve default servicing operations and borrower communications.

STRATMOR Group’s Michael Grad: Unlocking Profits from Servicing Assets

With interest rates soaring, most lenders are struggling to generate enough profit from originations to sustain business. And when they are incurring losses with each loan originated, many have turned their attention to mortgage servicing rights for extra revenue.

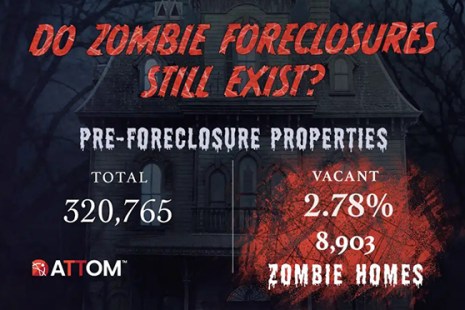

‘Zombie’ Foreclosures Rise as Lenders Pursue More Delinquent Mortgages: ATTOM

Nearly 1.3 million residential properties in the United States are vacant, according to ATTOM, Irvine, Calif.

MBA NewsLink Q&A: Donna Schmidt of DLS Servicing on the FHA Loss Mitigation Waterfall

MBA NewsLink spoke with DLS Servicing’s Donna Schmidt on the FHA loss mitigation waterfall.

Cenlar’s Lori Pinto, CMB: Delivering the Best Homeowner Experience

The only constant in the mortgage marketplace has been a lot of change – and that change is happening fast. As a result, there’s been an ever-increasing demand that those of us who service home mortgages need to pivot quickly to adapt and, as always, remain committed to putting the homeowner first.

Cenlar’s Lori Pinto, CMB: Delivering the Best Homeowner Experience

The only constant in the mortgage marketplace has been a lot of change – and that change is happening fast. As a result, there’s been an ever-increasing demand that those of us who service home mortgages need to pivot quickly to adapt and, as always, remain committed to putting the homeowner first.