This is a sponsored webinar. Please be advised your contact information will be shared with the sponsor. In today’s challenging economic environment, mortgage servicers face significant pressure to control costs. …

Tag: Servicing

S&P: U.S. Insurers, Homeowners Face Greater Risks and Costs Due to Extreme Weather

U.S. insurers and homeowners face greater risks and higher costs as extreme weather events including hurricanes, wildfires and floods become more frequent and intense, according to S&P Global Ratings, New York.

Harnessing the Full Potential of the Mortgage Capital Markets–Rocktop’s Brett Benson

Imagine a day when the mortgage and other fixed-income markets operate like transparent and seamless exchanges. That’s the vision of Brett Benson, Co-President and Chief Investment Officer of Rocktop.

Harnessing the Full Potential of the Mortgage Capital Markets–Brett Benson From Rocktop

Imagine a day when the mortgage and other fixed-income markets operate like transparent and seamless exchanges. That’s the vision of Brett Benson, Co-President and Chief Investment Officer of Rocktop.

Brett Benson From Rocktop: Harnessing the Full Potential of the Mortgage Capital Markets

Imagine a day when the mortgage and other fixed-income markets operate like transparent and seamless exchanges. That’s the vision of Brett Benson, Co-President and Chief Investment Officer of Rocktop.

Auction.com Finds Most Default Servicers Expect Soft Landing, Slowly Rising Foreclosures

Most default servicers expect a soft landing in the economy and a gradual increase in foreclosure volumes in the second half of 2024, according to Auction.com, Irvine, Calif.

GSEs Completed 52,154 Foreclosure Prevention Actions in 1Q, FHFA Finds

Fannie Mae and Freddie Mac completed more than 52,000 foreclosure prevention actions in the first quarter, bringing the total to nearly 7 million since the start of conservatorships, the Federal Housing Finance Agency reported.

DLS Servicing’s Donna Schmidt: For Many, Short Sales Represent the Most Graceful Foreclosure Option

In today’s complex mortgage servicing landscape, the ultimate goal is not just to protect investors, but also to facilitate the best possible outcomes for borrowers.

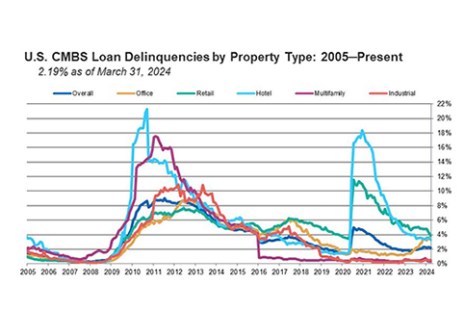

High Resolution Volume Drives CMBS Delinquency Rate Lower, Fitch Reports

The U.S. commercial mortgage-backed securities delinquency rate decreased nine basis points to 2.19% in March, according to Fitch Ratings, New York.

Clarifire’s Jane Mason: Imagination and Automation–Do You Have it?

As mortgage servicers gathered in Orlando in February for the annual MBA Servicing Solutions Conference & Expo, one session, “Executives Discuss Their Challenges and Goals,” revealed a consistent need and desire to reimagine mortgage servicing.