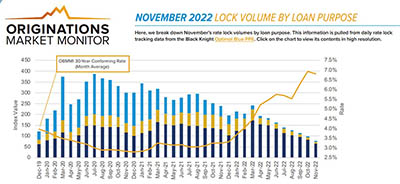

Black Knight, Jacksonville, Fla., reported despite a nearly half-percentage-point decrease in mortgage interest rates, overall lock volumes dropped by 21.5% in November and are down 39% over the past three months and 68% off last year.

Tag: Scott Happ

Cash-Outs, Purchase Locks Decline Amid Record-Low Affordability

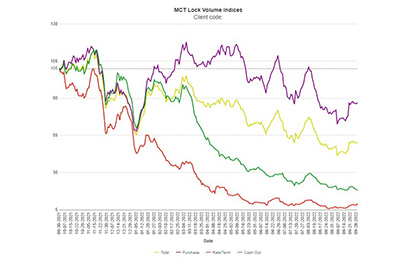

Black Knight, Jacksonville, Fla., said cash-out refinances fell significantly in September, by 26.2 percent from August alone and by 78 percent from a year ago. A similar report from MCT, San Diego, also found a sharp drop in loan lock volume in September.

Housing Market Roundup Sept. 15, 2022

Here’s a quick summary of recent housing market reports that have come across the MBA NewsLink desk:

Black Knight: Mortgage Production Continues to Decline; Purchase Demand Now Falling Below Pre-Pandemic Levels

Black Knight, Jacksonville, Fla., said mortgage production pulled back at the end of July, falling by 49 basis points from June to 5.30%.

Rate Locks Fall Across All Loan Types

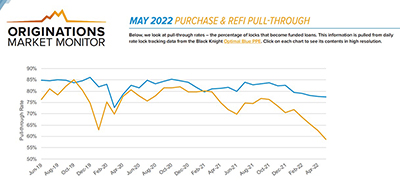

Black Knight, Jacksonville, Fla., said despite a leveling off in interest rates, lock volumes fell another 4.8% from April, with monthly declines seen across both rate/term (-23.6%) and cash-out (-11.9%) refinances.

Black Knight: Rate Lock Activity Falls as Interest Rates Climb

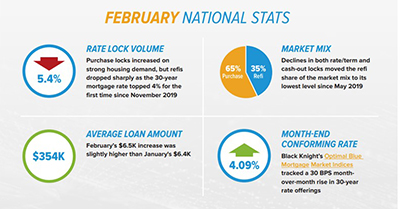

Black Knight, Jacksonville, Fla., said amid rising interest rates, rate-lock production fell by nearly 20 percent in March, led by a sharp drop—more than 50 percent—in rate/term refinance activity.

Housing Market Roundup Mar. 15, 2022

Here’s a quick recap of housing market stories that have recently come across the MBA NewsLink desk:

Black Knight: Origination Activity Slows for 4th Straight Month

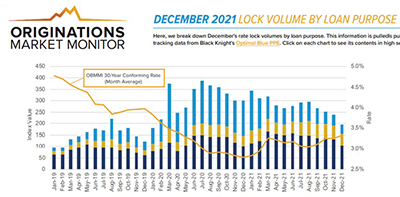

Black Knight, Jacksonville, Fla., said origination activity fell for the fourth straight month in December, with rate lock volume falling to its lowest level in two years.

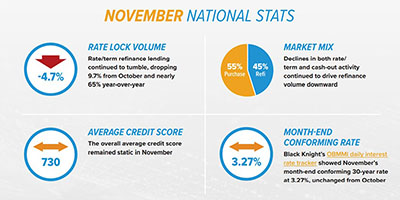

Black Knight: November Rate Locks Down 7.4%; Refis 65% Below Year Ago

Black Knight, Jacksonville, Fla., said November marked the third consecutive monthly decline in overall origination volume, bringing it to its lowest level since February 2020, prior to the onset of the pandemic.

Housing Market Roundup Nov. 9, 2021

We’re starting to get a lot of year-end housing market reports—which means we should be soon getting 2022 forecasts. Here is a roundup of recent reports to come across the MBA NewsLink desk: