The Mortgage Bankers Association’s MBA Opens Doors Foundation (Opens Doors Foundation) recently announced it had crossed the threshold of helping more than 15,000 families in their time of need. What started as a desire to help families with critically ill children stay in their homes while their child is in treatment has blossomed into a full-fledged support system for thousands of families across the country.

Tag: Robert Broeksmit CMB

Charity Spotlight: MBA Opens Doors Foundation

The Mortgage Bankers Association’s MBA Opens Doors Foundation (Opens Doors Foundation) recently announced it had crossed the threshold of helping more than 15,000 families in their time of need. What started as a desire to help families with critically ill children stay in their homes while their child is in treatment has blossomed into a full-fledged support system for thousands of families across the country.

MBA’s Broeksmit: Why Mortgage Rates Continue to Rise and What Can Be Done

As mortgage rates reached 23-year highs in MBA’s latest Weekly Applications Survey and application activity fell to a low last seen in 1996, MBA President and CEO Robert Broeksmit, CMB, issued the following statement.

MBA’s Broeksmit: Why Mortgage Rates Continue to Rise and What Can Be Done

As mortgage rates reached 23-year highs in MBA’s latest Weekly Applications Survey and application activity fell to a low last seen in 1996, MBA President and CEO Robert Broeksmit, CMB, issued the following statement.

Quote: Oct. 6, 2023

“The challenging rate environment is a product of many factors and is likely to persist, but these steps by the Fed would help to reassure investors and should provide relief. MBA continues to fight on your behalf with regulators, policymakers on both sides of the aisle, the GSEs, and the Fed.”

–MBA President and CEO Robert Broeksmit, CMB

Quote: Oct. 5, 2023

“We’ve got a 44-year low in mortgage delinquencies.”

–MBA President and CEO Robert Broeksmit, CMB, on CNBC’s Closing Bell Overtime

Quote: Oct. 2, 2023

“President Biden signed the bill [that funds the federal government] into law before midnight, ensuring that all the various government-supported segments of the mortgage market, including HUD (Ginnie Mae and FHA included), USDA, and the VA will continue to operate uninterrupted.”

–MBA President Robert Broeksmit, CMB.

MBA’s Broeksmit Comments on Potential Government Shutdown

Mortgage Bankers Association President & CEO Robert D. Broeksmit, CMB, commented Monday on a potential government shutdown at the end of the fiscal year.

MBA’s Broeksmit Comments on Potential Government Shutdown

Mortgage Bankers Association President & CEO Robert D. Broeksmit, CMB, commented yesterday on a potential government shutdown at the end of the fiscal year.

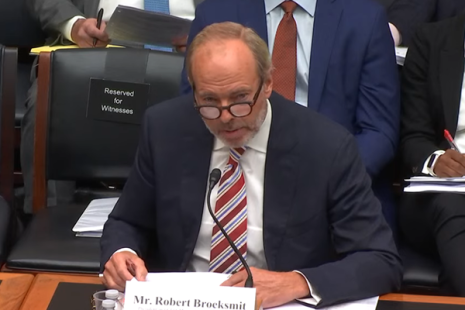

Broeksmit Testifies That MBA Opposes Certain Provisions of the Basel III Proposal

MBA President and CEO Robert Broeksmit, CMB, testified before Congress yesterday. He told the House Financial Services Committee that MBA strongly opposes key elements of the Basel III proposal, which, absent significant revisions, could increase borrowing costs and reduce credit availability.