There is more to spinning today’s volume into gold than efficiently originating high quality loans. For independent mortgage banks, the name of the game is liquidity. Lenders with an eye and a taste for transformative growth are equally attentive to their liquidity strategies, including how their origination practices impact liquidity now and after the current cycle ends.

Tag: Representations and Warranties

Christy Moss, CMB, and Ken Logan, CMB: Reps and Warrants Relief Key to IMB Liquidity Strategies

There is more to spinning today’s volume into gold than efficiently originating high quality loans. For independent mortgage banks, the name of the game is liquidity. Lenders with an eye and a taste for transformative growth are equally attentive to their liquidity strategies, including how their origination practices impact liquidity now and after the current cycle ends.

Christy Moss, CMB, and Ken Logan, CMB: Reps and Warrants Relief Key to IMB Liquidity Strategies

There is more to spinning today’s volume into gold than efficiently originating high quality loans. For independent mortgage banks, the name of the game is liquidity. Lenders with an eye and a taste for transformative growth are equally attentive to their liquidity strategies, including how their origination practices impact liquidity now and after the current cycle ends.

Christy Moss, CMB, and Ken Logan, CMB: Reps and Warrants Relief Key to IMB Liquidity Strategies

There is more to spinning today’s volume into gold than efficiently originating high quality loans. For independent mortgage banks, the name of the game is liquidity. Lenders with an eye and a taste for transformative growth are equally attentive to their liquidity strategies, including how their origination practices impact liquidity now and after the current cycle ends.

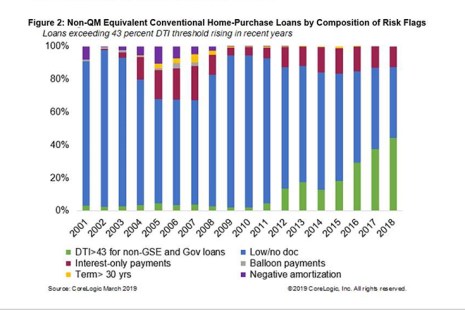

Portfolio Risk Management: Repurchase Risk for Non-QM Mortgages

In the wake of the 2008 global financial crisis, many risk managers in the mortgage issuance industry were caught flat-footed with representations and warranties exposure, also commonly known as repurchase exposure.

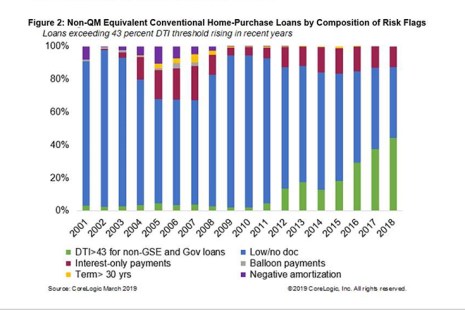

Portfolio Risk Management: Repurchase Risk for Non-QM Mortgages

In the wake of the 2008 global financial crisis, many risk managers in the mortgage issuance industry were caught flat-footed with representations and warranties exposure, also commonly known as repurchase exposure.

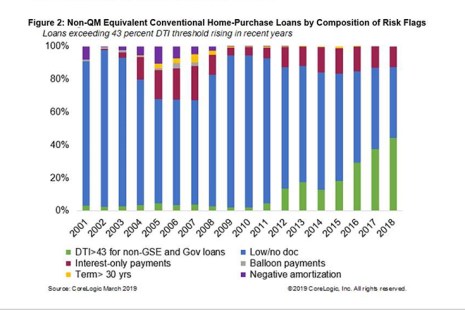

Portfolio Risk Management: Repurchase Risk for Non-QM Mortgages

In the wake of the 2008 global financial crisis, many risk managers in the mortgage issuance industry were caught flat-footed with representations and warranties exposure, also commonly known as repurchase exposure.

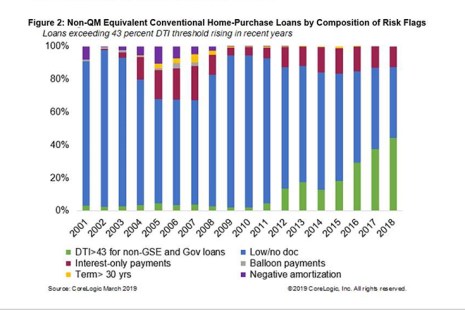

Portfolio Risk Management: Repurchase Risk for Non-QM Mortgages

In the wake of the 2008 global financial crisis, many risk managers in the mortgage issuance industry were caught flat-footed with representations and warranties exposure, also commonly known as repurchase exposure.