Among the many housing reports that came across our desk this week: Genworth Mortgage Insurance said 2020 was the “best year on record” for first-time home buyers; Radian said February home prices accelerated; Black Knight reported mortgage delinquencies rose for the first time in nine months; and Redfin said the home-buying process is becoming a headache for many consumers.

Tag: Redfin

In Bidding Wars, Cash—Especially All-Cash—is King

With more than half of home sales in many U.S. markets seeing multiple offers, one strategy seems to be working in winning the bidding war—cold, hard cash.

Housing Market Roundup—Mar. 19, 2021

Here’s a rapid-fire summary of recent reports on the housing and housing finance industries:

Housing Market Roundup: Mar. 12, 2021

Lots of housing market reports piling up in the MBA NewsLink inbox. Let’s get going:

Despite Home-Equity Uptick, Black American Median Home Values Lag Behind

Despite promising data showing substantial gains in home equity, Black Americans still lag well behind other demographic cohorts, according to a new report from Redfin, Seattle.

Industry Briefs Mar. 8, 2021

Ginnie Mae, Washington, D.C., said mortgage-backed securities issuance volume fell in February to $76.92 billion, down from the record $82.6 billion issued in January.

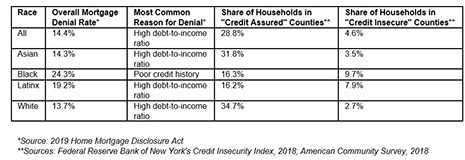

Reports Cite Progress—and Work to Do—for Female/Minority Home Buyers

Two reports illustrate both the progress made in lending to women and minorities and the challenges lenders continue to face in expanding minority homeownership.

Industry Briefs Mar. 3, 2021

Equifax, Atlanta, launched its Ignite Lost Sales Analysis platform, which leverages the Equifax cloud to provide the differentiated data, actionable insights and clear visualizations lenders need during prospecting, origination and portfolio retention.

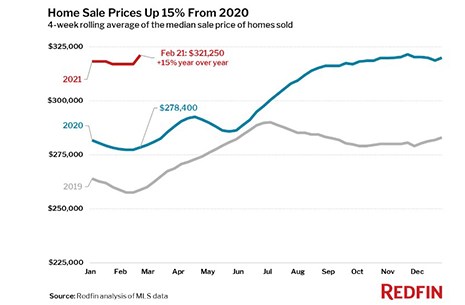

Redfin: New Listings Fall 17%, Home Prices Rise 15%

Redfin, Seattle, reported the median home sale price increased 15% year over year to $321,250 for the four-week period ending Feb 21.

2021 Housing Market ‘Red Hot’

The past year has been like no other, housing-wise. Near-record-low interest rates, tight housing supplies and greater flexibility in where one lives have pushed a normally predictable housing cycle into uncharted territory, as three new housing reports show.