Home sellers are increasingly ceding to the mounting pressure on affordability posed by rapid mortgage rate hikes, reported Redfin, Seattle.

Tag: Redfin

Industry Briefs July 1, 2022

Southwest Stage Funding LLC, dba Cascade Financial Services, a national provider of financing to buyers of manufactured homes, launch its Social Bond Framework, which furthers the company’s commitment to creating pathways for affordable housing.

Redfin: Demand for Vacation Homes Falls Below Pre-Pandemic Levels

Redfin, Seattle, said demand for vacation homes has fallen below the pre-pandemic baseline for the first time in two years, with mortgage-rate locks for second homes down 4 percent from before the pandemic in May.

Redfin: Demand for Vacation Homes Falls Below Pre-Pandemic Levels

Redfin, Seattle, said demand for vacation homes has fallen below the pre-pandemic baseline for the first time in two years, with mortgage-rate locks for second homes down 4 percent from before the pandemic in May.

Housing Market Roundup: June 29, 2022

Here is a summary of recent housing, market and economic reports that have come across the MBA NewsLink desk:

Redfin: Demand for Vacation Homes Falls Below Pre-Pandemic Levels

Redfin, Seattle, said demand for vacation homes has fallen below the pre-pandemic baseline for the first time in two years, with mortgage-rate locks for second homes down 4 percent from before the pandemic in May.

Homebuyers on $2,500 Monthly Budget Lose $118,000 in Spending Power in 2022

Redfin, Seattle, said a homebuyer on a $2,500 monthly budget has lost nearly $120,000 in spending power since the end of last year as mortgage rates have nearly doubled.

Single-Family Rental Investors Purchasing Fewer Houses

Redfin, Seattle, reported single-family rental real estate investors purchased fewer houses in the first quarter than in prior quarters.

Luxury Home Sales See Biggest Decline Since Start of Pandemic

Redfin, Seattle, said sales of luxury U.S. homes fell 17.8% year over year during the three months ending April 30, the largest drop since the onset of the coronavirus pandemic sent shockwaves through the housing market.

A Summer Housing Market Cooldown?

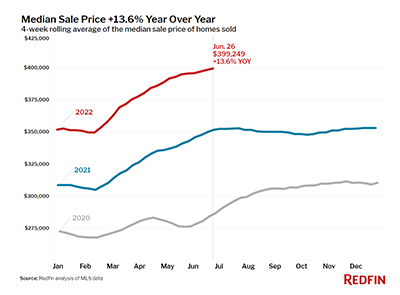

Reports from House Canary, Washington, D.C., and Redfin, Seattle, point to slowing housing market activity this summer following a breakneck pace over the past two years.