Condo Prices Offer Homebuyers Little Solace

(Condominiums in Fairfax County, Va.)

MBA NewsLink Staff

Record-high prices and scant inventories are driving many homebuyers to the condominium market—but they’re not finding opportunities there, either.

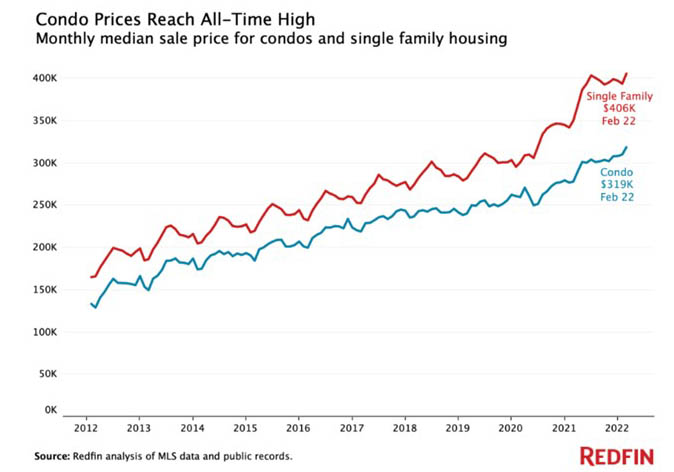

Redfin, Seattle, said the typical U.S. condo sold for a record $319,000 in February, up 14.6% from a year earlier and 22.7% from two years earlier, just before the pandemic began. And would-be condo buyers are seeing the same issues facing the red-hot single-family homes market—rapidly rising prices; rapidly dwindling inventories; and fierce competition.

“The condo market has bounced back,” said Chance Glover, a Redfin manager in Boston. “People are no longer afraid to live downtown, close to the crowds—and they often prefer it, because they’re close to the office and all the amenities of the city. Rising prices are pushing single-family homes out of reach for a lot of buyers, so condos are affordable in comparison.”

The report said condos are in demand partly because they’re a comparatively affordable option amid skyrocketing home prices and rising mortgage rates. Single-family home prices hit a record $406,000 in February, up 15.9% year over year and up 34.9% from two years earlier.

Glover noted that condos are nearly as hot as single-family homes marks a big shift from the beginning of the pandemic, when remote work and nerves about crowded spaces caused condo sales to plummet a record 48% and prices to drop the most since 2012. Now, with coronavirus cases declining and some Americans returning to the office, condos are an attractive option once again.

The report said condo supply was just shy of a record low in February, down 28% year over year. New condo listings were down 6.1%. Condos are experiencing an even bigger inventory decline than single-family homes, which saw a 14% year-over-year drop and a 2.5% drop in new listings. The supply shortage held back condo sales, which were down 5.3% year over year, in line with the decline for single-family homes. But condo sales were up 13% from February 2020, while sales of single-family homes were essentially flat over that same period.

Redfin reported a record 55.1% of condos went off the market within two weeks in February, up from 47.9% a year earlier. The typical condo that sold in February went under contract in 30 days, 13 days faster than a year earlier. By comparison, 62.1% of single-family homes sold within two weeks (versus 58.2% a year earlier), and the typical single-family home sold in 24 days (seven days faster than a year earlier).

And while nearly two-thirds (64.6%) of condo offers written by Redfin agents faced competition in February, up from 49.3% a year earlier, it’s not nearly as bad as the current single-family market—72.9% of offers for single-family homes faced bidding wars.

Meanwhile, 41.1% of condos sold above asking price, up from 24.9% a year earlier—another sign of increasing competition. Houses are still a bit more competitive, with 48.4% of single-family homes selling above list price (up from 38.2% a year earlier).

Redfin reported the typical condo sold for 0.6% above its asking price, near the record 0.7% premium set in June 2021. Last May marked the first time on record the typical condo sold for more than its asking price. The typical single-family home sold for 1.4% above asking price.