The Mortgage Bankers Association (MBA) announced at its 2026 Commercial/Multifamily Finance Convention and Expo that total commercial mortgage origination volume is forecasted to increase to $805.5 billion in 2026 from the $633.7 billion expected in 2025. Multifamily origination volume is expected to increase as well to $399.2 billion in 2026 from the $330.6 billion expected in 2025.

Tag: originations

ICE Mortgage Monitor: Originations Hit Highest Quarterly Volume Since 2022

ICE Mortgage Technology, Atlanta, released its latest Mortgage Monitor report, finding that mortgage originations saw their highest quarterly volume in Q2 since 2022.

ATTOM: Mortgage Originations Fall in Q1

ATTOM, Irvine, Calif., released its Q1 2025 U.S. Residential Property Mortgage Origination Report, highlighting that there were 1.4 million mortgages secured by residential property in the period. That’s a 14% drop from Q4 2024.

Optimal Blue: February Sees Surge in Rate-and-Term Refinances

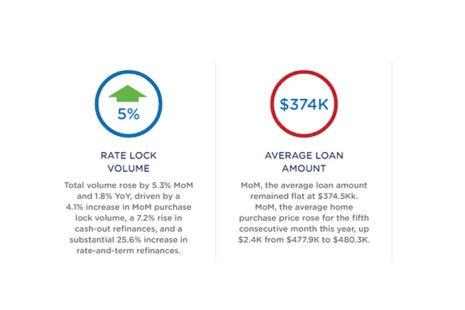

Optimal Blue, Plano, Texas, recorded a 7% month-over-month increase in mortgage lock volume in February, largely driven by strong refinance activity.

VantageScore CreditGauge: Mortgages Help Drive Credit Balance Increases in January

VantageScore, San Francisco, released its CreditGauge report for January, finding average overall credit account balances rose by more than $1,000 from December 2024.

VantageScore: Overall Credit Balances Up in October, Driven by Mortgages

VantageScore, San Francisco, released its October CreditGauge, finding overall balances hit a new metric record for the fourth straight month.

MBA: Commercial/Multifamily Borrowing Increased 3% in the Second Quarter

Commercial and multifamily mortgage loan originations increased 3% in the second quarter compared to a year ago and increased 27% from the first quarter, according to MBA’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

Optimal Blue: Rate-and-Term Refis Jump in May

Optimal Blue, Plano, Texas, released its Market Advantage Mortgage Data Report for May, finding, among other metrics, an almost 26% increase in rate-and-term refinances in May.

ATTOM: Mortgage Lending Drops in Q1

ATTOM, Irvine, Calif., released its first-quarter U.S. Residential Property Mortgage Origination report, revealing that 1.28 million mortgages secured by residential property were issued in the quarter.

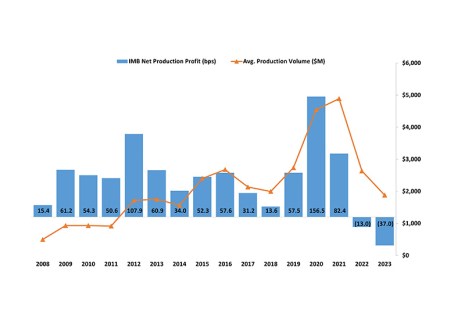

MBA: IMB Production Losses Reach Series High in 2023

Independent mortgage banks and mortgage subsidiaries of chartered banks lost an average of $1,056 on each loan they originated in 2023, down from an average loss of $301 per loan in 2023. This represents a series high in the 15-year history of the MBA Annual Mortgage Bankers Performance Report.