Freddie Mac: Multifamily Demand Returning Slowly in Uncertain Economic Climate

(Courtesy Freddie Mac)

Freddie Mac, McLean, Va., projects the multifamily market will continue to stabilize but see below-average growth through the rest of the year.

The sector’s macroeconomic headwinds including the elevated 10-Year Treasury rate will lead to a contraction in multifamily origination volume to $370 billion, Freddie Mac said in its Multifamily 2023 Midyear Outlook. However, the economy is maintaining positive momentum, propelled by a strong labor market helping to maintain multifamily fundamentals.

“Midway through the year, we are starting to see a return to more normal patterns, although performance is a bit weaker,” said Sara Hoffmann, director of multifamily research at Freddie Mac. “We expect multifamily fundamentals to perform slightly below long-term averages this year, which will feel particularly slow compared with the pandemic boom years, and even the years leading up to it. But positive demand and modest rent growth indicate the multifamily market is stabilizing.”

Other key findings from the Midyear Outlook:

Uncertainty Remains in the Economy

Growth expectations for the economy are lower, but the economy has managed to avoid a recession so far this year, primarily due to the strength of the labor market, the report noted. “At the same time, inflation growth is moderating, while interest rates are elevated,” Freddie Mac said. “The continued strength of the labor market will support household formations and in turn the multifamily market through this year, but at relatively modest levels. Over the longer term, the multifamily market will continue to be propelled by an overall housing shortage, expensive for-sale housing and favorable demographics.”

Stabilizing Multifamily Market

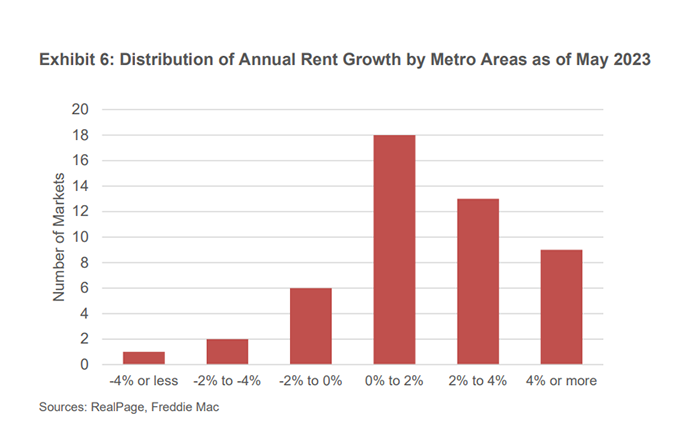

“Through the first half of 2023, the multifamily market appears to be returning to a more normal seasonal pattern, although slightly weaker than the years leading up to the pandemic,” the report said. “After falling during 2022, demand was positive during the first half, which led to positive rent growth. Meanwhile occupancy rates have declined slightly so far in 2023, albeit at a much slower pace than 2022, and are near the long-term average.”

There is an active pipeline of new units entering the market, mostly in the Class A space, along with slower economic growth, and this will put some stress on multifamily fundamentals, resulting in less-than-average growth for 2023, the report said: “Freddie Mac expects rent growth to remain modest this year as the market continues to work through uncertainty and elevated new supply.”

Origination Volume Decline

With greater economic uncertainty and the elevated and somewhat volatile interest rate environment, multifamily transaction value has slowed. “The upward pressure on cap rates due to the higher 10-Year Treasury rate has put downward pressure on property prices,” Freddie Mac said. “Additionally, given the higher interest rates and slowing fundamentals, buyers and sellers are having a hard time agreeing on asset value. As a result, Freddie Mac expects originations in 2023 to experience a contraction to $370 billion, down 17% from 2022.”