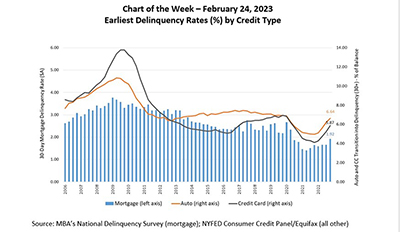

The latest credit delinquency data from both MBA and other sources indicates that delinquencies are rising. In MBA’s National Delinquency Survey, covering national and state delinquencies through the fourth quarter of 2022 revealed that the delinquency rate for mortgage loans on one‐to‐four‐unit residential properties rose to a seasonally adjusted rate of 4.96 percent of all loans outstanding at the end of the fourth quarter.

Tag: Mortgage Servicing

Sponsored Content from FICS: Mortgage Servicing Software: The Key to Servicing Retention

The right mortgage servicing software supports servicing retention and improves communication, benefiting lenders and borrowers.

Rodney Moss of LoanCare on the New Servicing Environment

Rodney Moss is Executive Vice President of Strategy and Business Development with LoanCare, Virginia Beach, Va.

Sponsored Content from FICS: Mortgage Servicing Software: The Key to Servicing Retention

The right mortgage servicing software supports servicing retention and improves communication, benefiting lenders and borrowers.

Rodney Moss of LoanCare on the New Servicing Environment

Rodney Moss is Executive Vice President of Strategy and Business Development with LoanCare, Virginia Beach, Va.

Rodney Moss of LoanCare on the New Servicing Environment

Rodney Moss is Executive Vice President of Strategy and Business Development with LoanCare, Virginia Beach, Va.

Rodney Moss of LoanCare on the New Servicing Environment

Rodney Moss is Executive Vice President of Strategy and Business Development with LoanCare, Virginia Beach, Va.

Rodney Moss of LoanCare on the New Servicing Environment

Rodney Moss is Executive Vice President of Strategy and Business Development with LoanCare, Virginia Beach, Va.

John Walsh of LERETA on Servicing Tax Issues

John Walsh is CEO of LERETA, Pomona, Calif. He leads an executive leadership team focused on providing the mortgage and insurance industries accuracy, responsiveness and innovative technology.

John Walsh of LERETA on Servicing Tax Issues

John Walsh is CEO of LERETA, Pomona, Calif. He leads an executive leadership team focused on providing the mortgage and insurance industries accuracy, responsiveness and innovative technology.