Paul Fischer is Director of Professional Services with Paradatec, Cincinnati.

Tag: Mortgage Servicing

FHFA, GSEs Offer Payment Deferral as Repayment Option for COVID-19 Forbearance Plans

The Federal Housing Finance Agency yesterday said Fannie Mae and Freddie Mac will employ a new payment deferral option allowing borrowers in COVID-19 related forbearance, who are able to return to making their normal monthly mortgage payment, the ability to repay their missed payments at the time the home is sold, refinanced, or at maturity.

Paul Fischer of Paradatec on What Mortgage Servicers Can Expect in Months Ahead

Paul Fischer is Director of Professional Services with Paradatec, Cincinnati.

FHFA, GSEs Offer Payment Deferral as Repayment Option for COVID-19 Forbearance Plans

The Federal Housing Finance Agency yesterday said Fannie Mae and Freddie Mac will employ a new payment deferral option allowing borrowers in COVID-19 related forbearance, who are able to return to making their normal monthly mortgage payment, the ability to repay their missed payments at the time the home is sold, refinanced, or at maturity.

Paul Fischer of Paradatec on What Mortgage Servicers Can Expect in Months Ahead

Paul Fischer is Director of Professional Services with Paradatec, Cincinnati.

Survey: More than Half of Mortgage, Auto Borrowers Concerned About Making Upcoming Payments

Bankrate.com, New York, said more than half of mortgage and auto loan borrowers (54% of each) are concerned about their ability to make their payments over the next three months.

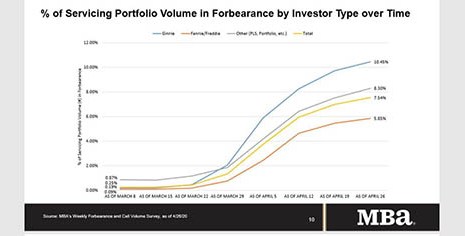

MBA: Share of Mortgage Loans in Forbearance Increases to 7.54%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed the number of loans now in forbearance increased from 6.99% of servicers’ portfolio volume in the prior week to 7.54% as of April 26. According to MBA’s estimate, a total of 3.80 million homeowners are now in forbearance plans.

MBA Launches Consumer Ad Campaign

The Mortgage Bankers Association launched a digital advertising campaign designed to help consumers facing financial challenges as a result of the COVID-19 pandemic and show how the mortgage industry is helping consumers through the coronavirus pandemic.

MISMO Launches Initiative to Apply Digital Mortgage Standards to Loan Modification Process

MISMO, the Mortgage Industry Standards Maintenance Organization, seeks industry participants to join its initiative of applying digital mortgage standards, guidelines and best practices to the loan modification process.

Andrew Foster: Case-By-Case–Commercial Mortgage Forbearance Consideration Begins

As mortgage lenders shift focus from production to portfolio management in response to COVID-19, industry shifts are occurring alongside the inevitable reallocation of lending operation resources.