MBA NewsLink interviewed Timothy E. Steward, Senior Vice President and co-head of Midland Loan Services, a PNC Real Estate business. Steward leads a team of more than 500 professionals responsible for delivering loan servicing, asset management and technology services to the commercial real estate finance industry.

Tag: Mortgage Servicing

Keeping Current With Midland Loan Services’ Tim Steward

MBA NewsLink interviewed Timothy E. Steward, Senior Vice President and co-head of Midland Loan Services, a PNC Real Estate business. Steward leads a team of more than 500 professionals responsible for delivering loan servicing, asset management and technology services to the commercial real estate finance industry.

Maurice Jourdain-Earl of ComplianceTech on CARES Act Relief and Racial Disparities in Mortgage Forbearance

MBA NewsLink talked with Maurice Jourdain-Earl, Managing Director of ComplianceTech, McLean, Va., a provider of software and services to enable fair and responsible lending compliance. He is a noted speaker and writer on HMDA and fair lending practices and has appeared frequently at MBA events and sits on MBA’s member-led Diversity & Inclusion Advisory Committee.

MBA: Share of Mortgage Loans in Forbearance Decreases for Third Straight Week to 8.39%

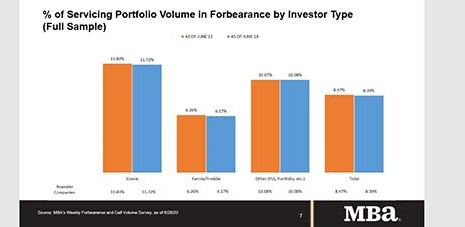

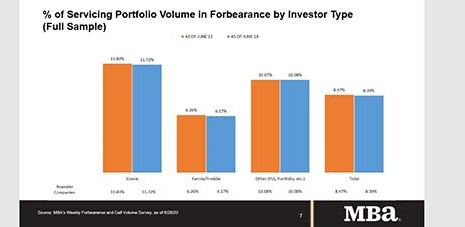

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 8 basis points to 8.39% of servicers’ portfolio volume as of June 28, compared to 8.47% the prior week. MBA estimates nearly 4.2 million homeowners are in forbearance plans.

MBA: Share of Mortgage Loans in Forbearance Decreases for Third Straight Week to 8.39%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey reported loans now in forbearance decreased by 8 basis points to 8.39% of servicers’ portfolio volume as of June 28, compared to 8.47% the prior week. MBA estimates nearly 4.2 million homeowners are in forbearance plans.

Anita Bush: Offering Forbearance Under the CARES Act – A New Reality for Mortgage Servicers

According to the latest Mortgage Banker Association Forbearance and Call Volume Survey, the total loans in forbearance stands at 8.47%. While the number of new forbearance requests is declining, many servicers may still be working with forbearance borrowers for the rest of this year and into 2021. Here’s what servicers can do to handle this new reality.

Anita Bush: Offering Forbearance Under the CARES Act – A New Reality for Mortgage Servicers

According to the latest Mortgage Banker Association Forbearance and Call Volume Survey, the total loans in forbearance stands at 8.47%. While the number of new forbearance requests is declining, many servicers may still be working with forbearance borrowers for the rest of this year and into 2021. Here’s what servicers can do to handle this new reality.

Anita Bush: Offering Forbearance Under the CARES Act – A New Reality for Mortgage Servicers

According to the latest Mortgage Banker Association Forbearance and Call Volume Survey, the total loans in forbearance stands at 8.47%. While the number of new forbearance requests is declining, many servicers may still be working with forbearance borrowers for the rest of this year and into 2021. Here’s what servicers can do to handle this new reality.

CFPB Issues Interpretive Rule on Determining Underserved Areas; Final Rule on Loss Mitigation Options for Homeowners with COVID-Related Hardships

The Consumer Financial Protection Bureau yesterday issued an interpretive rule to provide guidance to creditors and other persons involved in the mortgage origination process about the way in which the Bureau determines which counties qualify as “underserved” for a given calendar year.

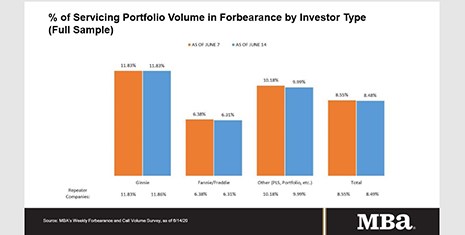

MBA: Shares of Loans in Forbearance Falls to 8.48%

The Mortgage Bankers Association’s latest Forbearance and Call Volume Survey showed loans now in forbearance decreased – for the first time since the survey’s inception in March – from 8.55% of servicers’ portfolio volume in the prior week to 8.48% as of June 14.