Leaders need to include software audits in their strategic planning process. A good software audit sets the stage for effective budgeting and decision making this fall. Leaders should analyze the company’s current Application Programming Interface integrations to existing mortgage software.

Tag: Mortgage Servicing

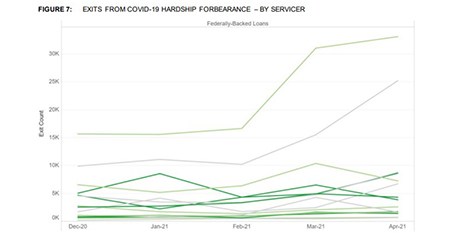

CFPB: Mortgage Servicers’ Pandemic Response Varies Significantly

The Consumer Financial Protection Bureau on Tuesday published a report detailing 16 large mortgage servicers’ COVID-19 pandemic response. The report showed a disparate response in call metrics, exit metrics and other measures.

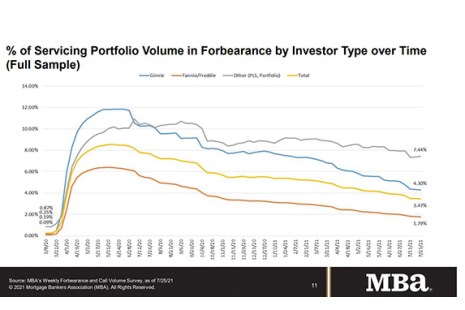

Share of Mortgage Loans in Forbearance Slightly Decreases

Loans in forbearance fell for the twenty-second consecutive week, the Mortgage Bankers Association said on Monday.

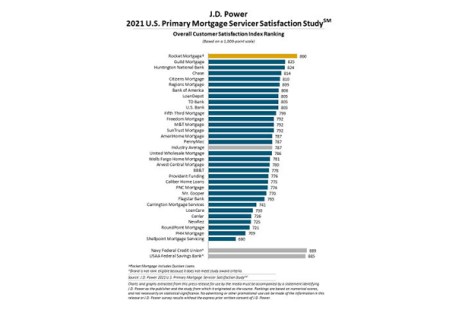

J.D. Power: Mortgage Servicers Get High Marks; Nonbanks Gain Traction

J.D. Power, Troy, Mich., said mortgage servicers earned high levels of customer satisfaction during the pandemic, but warned as loan forbearance programs come to an end and more normalized customer interactions resume, traditional banks are starting to lose their edge over non-bank lenders.

MBA Supports CSBS Prudential Standards for Nonbank Mortgage Servicers

On Tuesday the Conference of State Bank Supervisors released model state regulatory prudential standards for nonbank mortgage servicers. MBA President and CEO Bob Broeksmit, CMB, immediately expressed support for the standards.

FHA Establishes New, Streamlined COVID-19 Recovery Loss Mitigation Options

The Federal Housing Administration on Friday published Mortgagee Letter 2021-18, COVID-19 Recovery Loss Mitigation Options. The ML outlines assistance for homeowners who have been financially impacted by the COVID-19 pandemic to remain in their homes with new, streamlined loss mitigation options.

FHA Establishes New, Streamlined COVID-19 Recovery Loss Mitigation Options

The Federal Housing Administration on Friday published Mortgagee Letter 2021-18, COVID-19 Recovery Loss Mitigation Options. The ML outlines assistance for homeowners who have been financially impacted by the COVID-19 pandemic to remain in their homes with new, streamlined loss mitigation options.

Murali Tirupati: How Mortgage Servicers Can Improve Operations with an ‘Automation-First’ Strategy

Mortgage servicers are under tremendous pressure to not just onboard loan files faster but do so in compliance with regulatory requirements of CFPB.

Murali Tirupati: How Mortgage Servicers Can Improve Operations with an ‘Automation-First’ Strategy

Mortgage servicers are under tremendous pressure to not just onboard loan files faster but do so in compliance with regulatory requirements of CFPB.

Jennifer Henry: The Role Third-Party Data Plays for Mortgage Originators and Servicers

Lenders and servicers alike must focus on streamlining processes through automated technology and data-enabled solutions to sustain a more profitable business model and manage the shifts and demands of the marketplace.