Fitch Ratings, New York, said commercial mortgage real estate investment trust ratings will continue to be challenged by post-pandemic occupancy rates, “with growing recessionary risks and further deterioration of commercial real estate fundamentals.”

Tag: Mortgage REITs

Bridge Over Troubled Water: Debt Funds and Mortgage REITs Come of Age During COVID-19

It can be challenging to raise capital for public companies involved in commercial real estate lending against a backdrop of falling stock prices. This has led to an inward focus on activities such as asset management and building liquidity for public mortgage REITs, making these market participants less active for new loan originations.

MBA Letter Urges FHFA to Diversify FHLB System Membership Base

The Mortgage Bankers Association, in a letter to Federal Housing Finance Agency Director Mark Calabria, urged FHFA to expand membership in the Federal Home Loan Bank system to include captive insurers, including mortgage real estate investment trusts and independent mortgage banks.

JLL, Wells Fargo Lead MBA 2019 Commercial/Multifamily Mortgage Firm Origination Volume Rankings

JLL, Wells Fargo and Eastdil Secured ranked as top commercial/multifamily mortgage originators last year, the Mortgage Bankers Association said today.

JLL, Wells Fargo Lead MBA 2019 Commercial/Multifamily Mortgage Firm Origination Volume Rankings

JLL, Wells Fargo and Eastdil Secured ranked as top commercial/multifamily mortgage originators last year, the Mortgage Bankers Association said today.

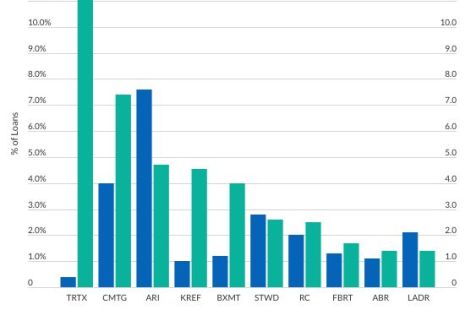

Investor-Driven Lender Growth in CRE Finance

The rise of debt funds, mortgage real estate investment trusts and other players in commercial real estate finance that MBA refers to broadly as “investor-driven lenders” has been at the heart of commercial real estate finance’s narrative this cycle–particularly in recent years.

Investor-Driven Lender Growth in CRE Finance

The rise of debt funds, mortgage real estate investment trusts and other players in commercial real estate finance that MBA refers to broadly as “investor-driven lenders” has been at the heart of commercial real estate finance’s narrative this cycle–particularly in recent years.