Fitch: Commercial mREIT Sector Faces Further Pressures in 2023

(Courtesy Fitch, New York)

Fitch Ratings, New York, said commercial mortgage real estate investment trust ratings will continue to be challenged by post-pandemic occupancy rates, “with growing recessionary risks and further deterioration of commercial real estate fundamentals.”

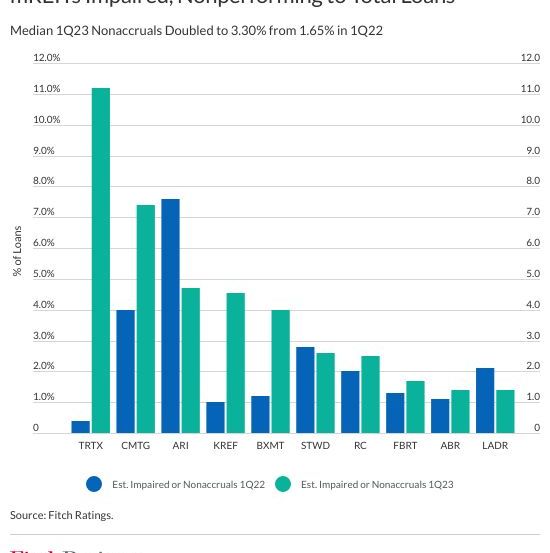

Commercial mREIT earnings have benefited from higher interest rates since early last year, but credit quality will likely worsen in 2023 and 2024, leading to weaker earnings, lower liquidity and higher leverage, Fitch said in a non-rating commentary, U.S. Commercial mREIT Sector Faces Further Pressures in 2023.

Fitch noted CRE asset values have been pressured over the last 12 months, with office, certain classes of multifamily and urban retail experiencing structural headwinds to valuations. “Lower net operating income and higher capitalization rates, key determinants of CRE valuations, have caused CRE prices to be reset at lower levels,” the commentary said. “As such, commercial mREITs have seen problem assets rise, with credit deterioration and limited growth opportunities expected to continue into 2024.”

The report said credit deterioration will be more acute for issuers with outsized office exposure in markets such as New York, Chicago and San Francisco and/or issuers with a larger percentage of pre-COVID originations. “Loans originated since the pandemic should have stronger credit performance in the near-to-medium term, as they were underwritten with less aggressive business plans and stronger terms and conditions across asset classes,” Fitch said.

Of the 10 largest commercial mREITs, Blackstone Mortgage Trust, KKR Real Estate Finance Trust and TPG RE Finance Trust have relatively larger exposure to office, the report said. Issuers with the most pre-pandemic originated loans include Claros Mortgage Trust, TPG RE Finance Trust and Apollo Commercial Real Estate Finance. “We believe even a mild recession would exacerbate headwinds to borrowers and/or deal sponsors attempting lease-ups or light conversions, leading to further deterioration in portfolios,” Fitch said.

Fitch said commercial mREITs’ ratings will remain constrained by the heavier use of secured funding sources over the near to medium term. “While some were able to access the senior unsecured or convertible bond market during the pandemic, meaningful high-yield spread widening, coupled with persistent CRE sector headwinds, will make unsecured debt issuance more challenging near-term,” the report noted.

“We expect commercial mREITs to be reliant on external, often confidence-sensitive debt funding sources, including bank repurchase facilities, collateralized loan obligations and term loans, leaving balance sheets mostly encumbered,” Fitch said. “Large commercial mREITs face $1.7 billion in collective debt maturities through 2024. Some issuers may be ultimately forced to use secured financing to pay off maturing unsecured issuances if challenging capital markets conditions persist into 2024. However, access to secured funding could be relatively more difficult or expensive compared to recent periods as bank lenders and investors have increased their scrutiny of loan collateral with ties to CRE.”