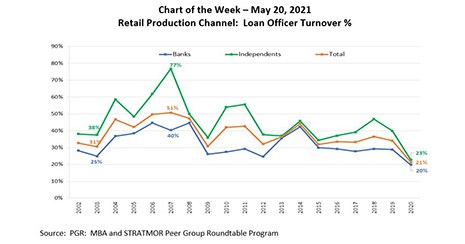

This week’s chart shows the historical retail Loan Officer turnover rates (%) for depository banks and independent mortgage companies, based on data collected through the MBA and STRATMOR Peer Group Roundtable Program, now in its 23rd year of production.

Tag: Mortgage Loan Originators

Bob Mansur, CMB, AMP: Your Actions When Your LOs Won’t Do It?

Our three previous articles made the argument for behavioral standards, how to set those expectations, and a valuable response to an LO’s efforts to meet your requirements. Those presentations assumed LOs are willing to change their actions to deliver required results. In this part we address how you might effectively respond when an underperforming LO lacks the motivation to make those changes.

Bob Mansur, CMB, AMP: Your Actions When Your LOs Won’t Do It?

Our three previous articles made the argument for behavioral standards, how to set those expectations, and a valuable response to an LO’s efforts to meet your requirements. Those presentations assumed LOs are willing to change their actions to deliver required results. In this part we address how you might effectively respond when an underperforming LO lacks the motivation to make those changes.

Bob Mansur, CMB, AMP: Your Actions When Your LOs Won’t Do It?

Our three previous articles made the argument for behavioral standards, how to set those expectations, and a valuable response to an LO’s efforts to meet your requirements. Those presentations assumed LOs are willing to change their actions to deliver required results. In this part we address how you might effectively respond when an underperforming LO lacks the motivation to make those changes.

Bob Mansur, CMB, AMP: Your Actions When Your LOs Won’t Do It?

Our three previous articles made the argument for behavioral standards, how to set those expectations, and a valuable response to an LO’s efforts to meet your requirements. Those presentations assumed LOs are willing to change their actions to deliver required results. In this part we address how you might effectively respond when an underperforming LO lacks the motivation to make those changes.

Bob Mansur, CMB, AMP: Your Actions When Your LOs Won’t Do It?

Our three previous articles made the argument for behavioral standards, how to set those expectations, and a valuable response to an LO’s efforts to meet your requirements. Those presentations assumed LOs are willing to change their actions to deliver required results. In this part we address how you might effectively respond when an underperforming LO lacks the motivation to make those changes.

Bob Mansur, CMB, AMP: Are You Guiding Your LOs to Perform Well?

In the initial article of this series, we addressed the value of setting behavioral requirements for LOs who are not reaching their goals to produce their agreed-upon numbers. The second article offered a process for setting standards so underperforming LOs know what’s expected of them. You’re about to read a presentation of how to respond when they strive to meet those behavioral standards.

Bob Mansur, CMB, AMP: Are You Guiding Your LOs to Perform Well?

In the initial article of this series, we addressed the value of setting behavioral requirements for LOs who are not reaching their goals to produce their agreed-upon numbers. The second article offered a process for setting standards so underperforming LOs know what’s expected of them. You’re about to read a presentation of how to respond when they strive to meet those behavioral standards.

Bob Mansur, CMB, AMP: Are You Guiding Your LOs to Perform Well?

In the initial article of this series, we addressed the value of setting behavioral requirements for LOs who are not reaching their goals to produce their agreed-upon numbers. The second article offered a process for setting standards so underperforming LOs know what’s expected of them. You’re about to read a presentation of how to respond when they strive to meet those behavioral standards.

Bob Mansur, CMB, AMP: Are You Guiding Your LOs to Perform Well?

In the initial article of this series, we addressed the value of setting behavioral requirements for LOs who are not reaching their goals to produce their agreed-upon numbers. The second article offered a process for setting standards so underperforming LOs know what’s expected of them. You’re about to read a presentation of how to respond when they strive to meet those behavioral standards.