Mortgage loan officers can no longer rely on bargain rates and that means they need to work harder than ever to best the competition. So how does a loan officer stand out? It’s all about social media.

Tag: Mortgage Loan Originators

Doug Wilber of Denim Social: In Tough Market, Mortgage Lenders Must Compete on Social Media

Mortgage loan officers can no longer rely on bargain rates and that means they need to work harder than ever to best the competition. So how does a loan officer stand out? It’s all about social media.

Fabio Rivas of LenderClose: Knowledge is Power: Creating Borrower Partnerships with Information

Being a better educator starts with having a full picture of the borrower’s financial situation. By taking a consultative approach, loan officers can ask questions to better understand what goals the potential borrower is trying to achieve. LOs can then provide the appropriate financial education that is relevant to best prepare them for homeownership.

Fabio Rivas of LenderClose: Knowledge is Power: Creating Borrower Partnerships with Information

Being a better educator starts with having a full picture of the borrower’s financial situation. By taking a consultative approach, loan officers can ask questions to better understand what goals the potential borrower is trying to achieve. LOs can then provide the appropriate financial education that is relevant to best prepare them for homeownership.

Sundeep Mathur of Tavant: The Technology-Enabled Loan Officer

One of the primary lessons of the COVID-19 crisis was that technology is an absolute requirement for business continuity in the mortgage industry and many others. This was a harsh lesson for many as mortgage lenders do not have a solid track record of adopting new technology promptly.

Sundeep Mathur of Tavant: The Technology-Enabled Loan Officer

One of the primary lessons of the COVID-19 crisis was that technology is an absolute requirement for business continuity in the mortgage industry and many others. This was a harsh lesson for many as mortgage lenders do not have a solid track record of adopting new technology promptly.

Sundeep Mathur of Tavant: The Technology-Enabled Loan Officer

One of the primary lessons of the COVID-19 crisis was that technology is an absolute requirement for business continuity in the mortgage industry and many others. This was a harsh lesson for many as mortgage lenders do not have a solid track record of adopting new technology promptly.

Sundeep Mathur of Tavant: The Technology-Enabled Loan Officer

One of the primary lessons of the COVID-19 crisis was that technology is an absolute requirement for business continuity in the mortgage industry and many others. This was a harsh lesson for many as mortgage lenders do not have a solid track record of adopting new technology promptly.

Lisa Springer, of STRATMOR Group: Relieving Workforce Burnout Through Technology

Lisa Springer is a senior partner and CEO of STRATMOR Group, Greenwood Village, Colo., a data-driven mortgage advisory firm. She provides direction and leadership to achieve the firm’s strategic goals.

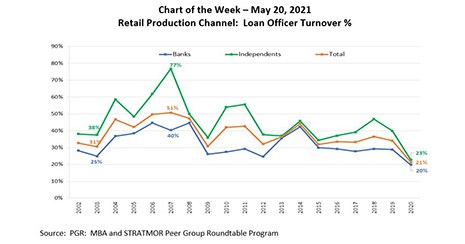

MBA Chart of the Week May 24 2021: Retail Production Channel Loan Officer Turnover

This week’s chart shows the historical retail Loan Officer turnover rates (%) for depository banks and independent mortgage companies, based on data collected through the MBA and STRATMOR Peer Group Roundtable Program, now in its 23rd year of production.