Cotality, Irvine, Calif., released its latest Loan Performance Indicators, finding that the national mortgage delinquency rate was flat year-over-year in December, standing at 3.2%.

Tag: Mortgage Delinquencies

ICE First Look: National Mortgage Delinquency Rate Edges Lower in January

Intercontinental Exchange, Atlanta, reported the national delinquency rate eased in January: delinquencies fell by 3 basis points to 3.65% and remain 15 basis points below the January 2020 pre-pandemic benchmark.

MBA: Mortgage Delinquencies Increase in the Fourth Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 4.26% of all loans outstanding at the end of the fourth quarter of 2025, according to MBA’s National Delinquency Survey.

MBA: Mortgage Delinquencies Increase in Third Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.99% of all loans outstanding at the end of the third quarter, according to MBA’s National Delinquency Survey.

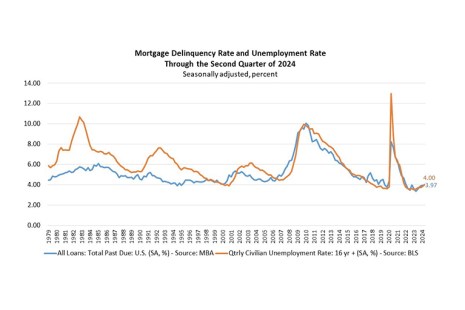

Mortgage Delinquencies Decrease Slightly in the Second Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties decreased to a seasonally adjusted rate of 3.93% of all loans outstanding at the end of the second quarter, according to MBA’s National Delinquency Survey.

Cotality: Mortgage Delinquencies Steady in March

Cotality, Irvine, Calif., released its Loan Performance Indicators, finding that delinquencies were flat in March on an annual basis.

Mortgage Delinquencies Increase Slightly in First Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 4.04% of all loans outstanding at the end of the first quarter, according to MBA’s National Delinquency Survey.

Commercial Mortgage Delinquency Rates Increase in Third Quarter

Commercial mortgage delinquencies increased in the third quarter of 2024, according to the Mortgage Bankers Association’s latest Commercial Delinquency Report.

TransUnion: Mortgage Delinquencies Tick Up but Remain Low

TransUnion, Chicago, released its Q3 2024 Credit Industry Insights Report, finding that mortgage delinquencies have slowly begun to increase among consumers.

MBA: Mortgage Delinquencies Increase in Second Quarter

The delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.97% of all loans outstanding at the end of the second quarter, MBA’s National Delinquency Survey found.