CoreLogic, Irvine, Calif., reported the overall mortgage delinquency rate was at 2.8% in February, down from 3% in February 2023.

Tag: Molly Boesel

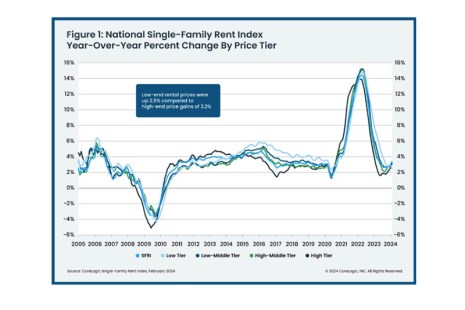

February Single-Family Rent Growth Strong, CoreLogic Finds

CoreLogic, Irvine, Calif., released its Single-Family Rent Index, finding rents rose 3.4% year-over-year in February. That’s the strongest growth recorded in 10 months.

CoreLogic: January Mortgage Delinquency Rate Near Record Low

CoreLogic, Irvine, Calif., said the U.S. housing market posted an overall delinquency rate of 2.8% in January, approaching a record low.

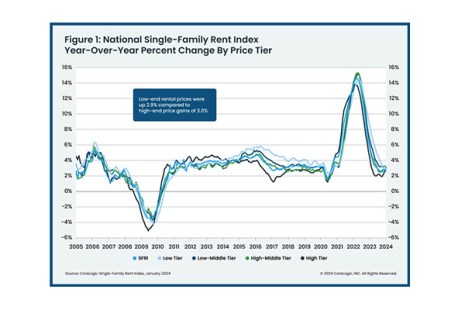

CoreLogic: Year-Over-Year Rent Growth at 2.6% in January

CoreLogic, Irvine, Calif., released its single-family rent index, showing single-family rental costs increased by 2.6% year-over-year in January.

CoreLogic: Delinquencies Nearly Flat in December

CoreLogic, Irvine, Calif., reported the national overall mortgage delinquency rate was 3.1% in December, up by 0.1 percentage point year-over-year from December 2022 and 0.2 percentage point from November.

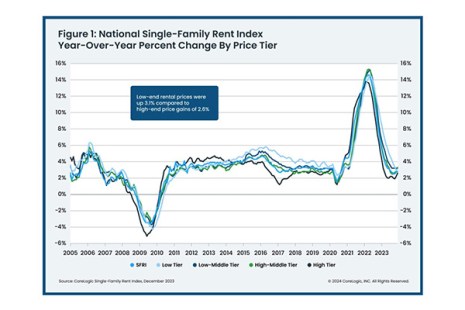

CoreLogic: Single-Family Rental Prices Up 2.8% in December

CoreLogic, Irvine, Calif., found single-family rent growth was consistent with pre-pandemic trends in December, with a 2.8% increase year-over-year.

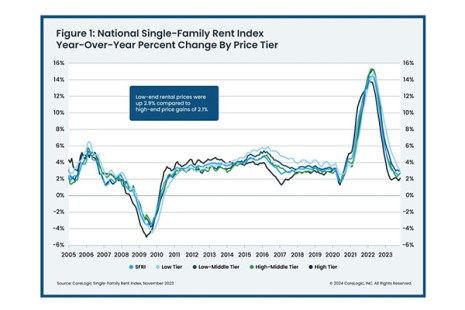

CoreLogic: Single-Family Rent Growth Continues Stable Pace

CoreLogic, Irvine, Calif., in its latest Single-Family Rent Index, found national single-family rent growth remained stable in November at 2.7%.

CoreLogic: October Delinquency Rate Flat

CoreLogic, Irvine, Calif., reported 2.8% of mortgages were delinquent by 30 or more days in October; the same rate was recorded in both September 2023 and October 2022.

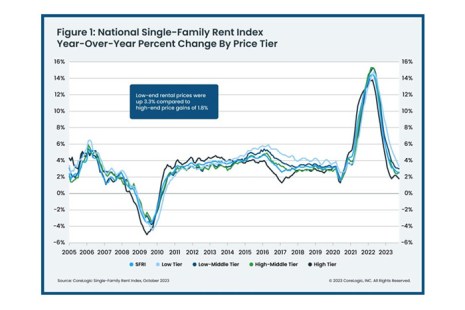

CoreLogic: October Single-Family Rent Index Shows Slower Growth

CoreLogic, Irvine, Calif., released its Single-Family Rent Index for October, finding year-over-year rent growth slipped to 2.5%.

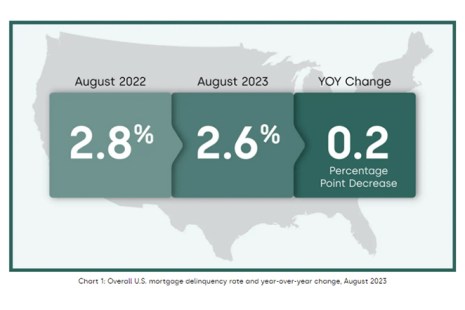

CoreLogic: Historic Low for Delinquencies in August

CoreLogic, Irvine, Calif., found in its Loan Performance Insights Report for August that the overall mortgage delinquency rate was at 2.6%, a historic low.